Written by: Global Asset Allocation Team | Putnam Investments

When we speculated at the beginning of the second quarter that this credit cycle could be “more compressed than previous cycles,” we certainly did not expect the cycle to be measured in weeks. As it turned out, the speed and ferocity of the monetary and fiscal policy responses around the world were unlike anything that any living professional investor had ever experienced. Just recall how many times the word “unprecedented” was used in commentaries in mid-March. This is probably why so many pros got it wrong by staying bearish as the S&P 500 recovered more than 85% of its losses over six weeks, beginning in late March.

Another highlight of the current environment — and a lowlight for forecasters — was the U.S. payrolls report by the Bureau of Labor Statistics on June 5. Before the release, the median estimate was for job losses of 7.5 million. The most optimistic estimate submitted by 78 economists called for job losses of 800,000. The actual number reported was a gain of more than 2.5 million! Clearly, there was no shortage of both bad information and bad commentary supporting outlooks for financial markets, the economy, and the pandemic.

Policy and politics on the horizon

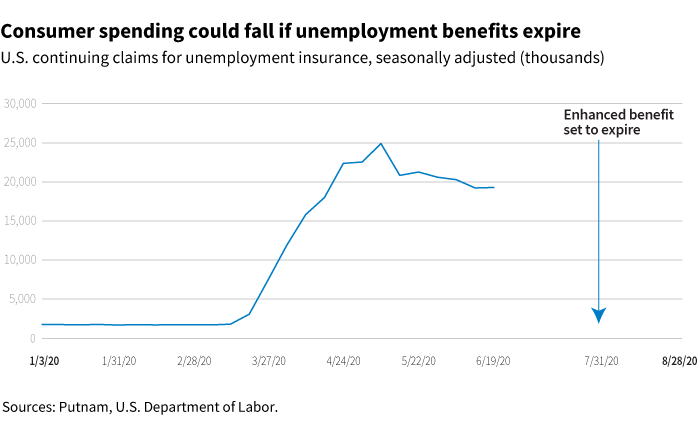

To be sure, there are plenty of risks that still need to be navigated over the balance of 2020. Perhaps the most pressing for the U.S. economy is the looming “fiscal cliff” to be caused by the expiration of enhanced unemployment benefits set to expire on July 31. Unless Congress moves quickly on a “CARES-2” package to extend those benefits, we could see a collapse in consumer spending by the 20 million Americans still collecting unemployment insurance. As we begin the third quarter, indications are growing that we are likely to see action on that front. If anything, the media coverage of a second wave of COVID-19 spreading in the “red states” of Arizona, Texas, and Florida might focus the minds of Senate Republicans on the topic.

Perhaps the most surprising element of the pandemic in the United States has been the extent to which both behavior and the narrative have been politicized. On the topic of political risk, the final days of the second quarter were not good for the current administration. Former Vice President Biden’s lead over President Trump in both national polls and in key swing states gapped to almost double digits, but have since stabilized. As we move closer to the U.S presidential election, the equity market could begin to price in the risk that Biden would quickly roll back the corporate tax cuts from the Tax Cuts and Jobs Act of 2017.

On the geopolitical front, while China continues to implement its commitments under the U.S.–China Phase 1 trade deal, tensions with the United States have escalated in other areas. These include the technology cold war, the recently passed national security law in Hong Kong, and increasing military provocations in the South China Sea.

Medical advances show promise

Finally, as we said last quarter, a medical problem still requires a medical solution, and the path of the pandemic will continue to loom large over financial markets. But since the early days of February, when the negative headlines were just beginning to spread across the world, there have been several advances. Healthcare providers globally have improved treatment and outcomes by providing anti-virals as an early intervention. Steroids and anti-inflammatory drugs have improved mortality rates in advanced cases. Several vaccine candidates will enter stage 3 human trials in July. New treatments such as antibody cocktails are also making strides, with more to be known by the fall. There will be, of course, setbacks and headline risk to navigate, but the distribution of outcomes has improved over the past quarter.

The market was shaky pre-pandemic

To understand the path that prices for risk assets have taken in 2Q20, one might go so far as to consider the virus a bit of a red herring. As we wrote at the beginning of the year, many risk assets were priced for perfection, with sentiment extremely optimistic and positioning overextended. It would not have taken much of an external shock to tip markets. The shock that occurred was indeed a large one. The 35% peak-to-trough decline in the S&P 500 over just 24 trading days, combined with the spike in implied volatility from the mid-teens to over 80%, flushed all of that optimism from the system. It left market positioning as light as we have seen in quite some time.

A rally with questionable conviction

Much ink has been used recently in writing about the resurgence in participation by the retail trading community. There is speculation that the combination of stay-at-home orders with the proliferation of zero-commission trading platforms has created an army of day traders. Some estimates place their recent activity as representing close to 40% of the volume in many NASDAQ stocks. We suspect those numbers are exaggerated by overall declining volumes after a period of position squaring and the generally slower summer period. Nevertheless, it bears watching closely, as the trends of retail trading are generally seen as a contrary indicator.

Our research indicates that positioning in risk assets on the part of systematic institutional strategies, which were large drivers of the moves in February and March, is relatively light. In addition, recent surveys of institutional discretionary investors indicate a great deal of FOMO (fear of missing out) in the market. Many managers missed a large portion of the rally and continue to be skeptical of high valuations based on current fundamentals.

With this backdrop in mind, we have reduced our dynamic asset allocation risk overall. Currently, we have a slight preference for high-yield credit over equity and a very slight underweight to duration. High yield looks more attractive as the Fed has ramped up support for corporate bonds in May and June through investments made by the Secondary Market Corporate Credit Facility. However, despite the Fed’s many programs, we expect the heightened volatility environment to persist, resulting in lower risk-adjusted returns

For informational purposes only. Not an investment recommendation.