Written by: Paul Rejczak

In the last five trading days (October 21 – October 27) the broad stock market has extended its short-term downtrend from October 12 local high. The S&P 500 index set a new record high of 3,588.11 on September 2. But then the market fell below February 19 high of 3,393.52 again. In late September it set a local low of 3,209.45 before going back above 3,500 mark. On October 12 it reached 3,549.85. So far, it looks like a medium-term consolidation following 63.7% rally from March 23 corona virus low at 2,191.86.

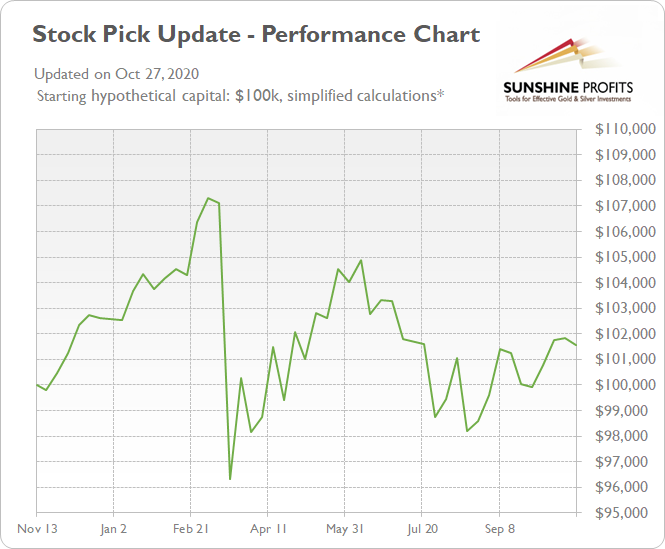

The S&P 500 index has lost 1.43% between October 21 and October 27. In the same period of time our five long and five short stock picks have lost 0.27%. So stock picks were relatively stronger than the broad stock market again . Our long stock picks have lost 1.35% but short stock picks have resulted in a gain of 0.80%.

There are risks that couldn’t be avoided in trading. Hence the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/ profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

This means that our overall stock-picking performance can be summarized on the chart below. The assumptions are: starting with $100k, no leverage used. The data before Dec 24, 2019 comes from our internal tests and data after that can be verified by individual Stock Pick Updates posted on our website.

Below we include statistics and the details of our three recent updates:

- October 27, 2020

- Long Picks (October 21 open – October 27 close % change): PPL (+1.96%), WDC (-3.40%), WYNN (-0.25%), XOM (-2.06%), LIN (-3.02%)

Short Picks (October 21 open – October 27 close % change): WMB (-1.12%), SHW (-0.23%), TROW (-2.61%), WEC (+1.63%), NVDA (-1.68%)

Average long result: -1.35%, average short result: +0.80%

Total profit (average): -0.27%

- October 20, 2020

Long Picks (October 14 open – October 20 close % change): CSCO (-1.63%), NI (+2.03%), CMG (+1.38%), XOM (-1.06%), SHW (-3.41%)

Short Picks (October 14 open – October 20 close % change): WMB (+1.33%), APD (-1.83%), JPM (+0.07%), NVDA (-4.51%), WEC (+1.47%)

Average long result: -0.54%, average short result: +0.69%

Total profit (average): +0.08%

- October 13, 2020

Long Picks (October 7 open – October 13 close % change): CMS (+2.71%), RTX (+0.35%), EQIX (+4.46%), OKE (+8.35%), FB (+6.53%)

Short Picks (October 7 open – October 13 close % change): COP (+4.21%), TWTR (+2.02%), NVDA (+1.78%), AWK (+1.39%), FDX (+3.37%)

Average long result: +4.48%, average short result: -2.55%

Total profit (average): +0.96%

Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, October 28 – Tuesday, November 3 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (October 28) and sold or bought back on the closing of the next Tuesday’s trading session (November 3).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are eleven stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETF’s .

The stock market sector analysis is available to our subscribers only.

Based on the above, we decided to choose our stock picks for the next week. We will choose our top 3 long and top 3 short candidates using trend-following approach, and top 2 long and top 2 short candidates using contrarian approach:

Trend-following approach:

- buys: 1 x Utilities, 1 x Communication Services, 1 x Consumer Discretionary

- sells: 1 x Energy, 1 x Real Estate, 1 x Industrials

Contrarian approach (betting against the recent trend):

- buys: 1 x Energy, 1 x Real Estate

- sells: 1 x Utilities, 1 x Communication Services

Trend-following approach

Top 3 Buy Candidates

D Dominion Energy, Inc. - Utilities

- Stock broke above short-term downward trend line - uptrend continuation play

- The resistance level of $85 and support level of $80

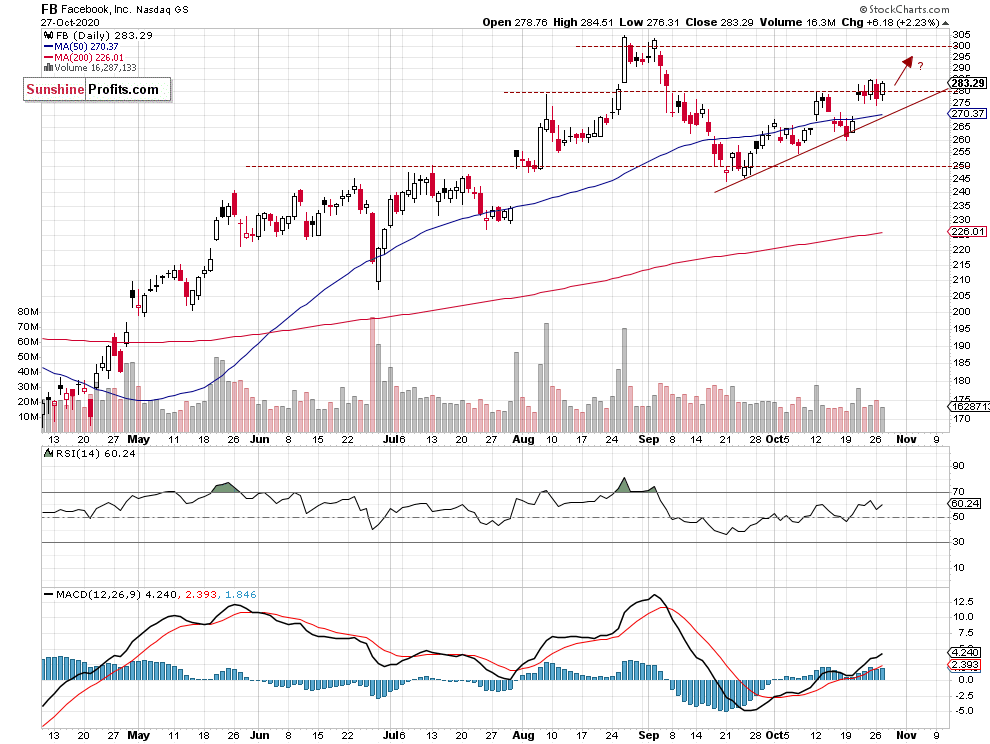

FB Facebook, Inc. – Communication Services

- Stock remains above upward trend line – possible short-term uptrend continuation

- The resistance level of $300

- The support level is at $260-270

WYNN Wynn Resorts Ltd – Consumer Discretionary

- Possible advance within an over month-long consolidation

- The resistance level is at $77.50

- The support level is at $67.50-70.00

Summing up, the above trend-following long stock picks are just a part of our whole Stock Pick Update . The Utilities, Communication Services and Consumer Discretionary sectors were relatively the strongest in the last 30 days. So that part of our ten long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.

Related: 3 Stocks Meant To Outperform in the Coming Days

DISCLOSURE: The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.