The S&P 500 Sectors Have One, Usual Standout. It’s a double-edged sword.

As a South Floridian, I had the pleasure of watching LeBron James lead the Miami Heat to NBA Championships. LeBron’s team has had a fighting chance nearly every year he has been in the league. The difference between the years his team won the NBA Title and those it didn’t came down to one thing: his supporting cast. No matter how great a Michael Jordan, Kobe Bryant, Wilt Chamberlain, Bill Russell, Kareem Abdul-Jabbar or LeBron James has been, they can’t do it alone.

The Technology sector of the S&P 500 has been like that for much of the past 25 years. It could carry the market, but only so far and for so long. Eventually, it was time to say “so long” to the one-sided market surge, and thus the bear market began. When I look at today’s S&P 500 sector picture, I can’t help but think back to the year 2000. And, not because Kobe and Shaq teamed up to bring Los Angeles a championship that year.

That was the year the Dot-Com Bubble started. And, while I have written about this period a couple of times recently, it pays to drill down a bit further. After all, part of hedged investing is recognizing both sides of a bubble: the melt-up at the end, and the melt-down that follows at some point.

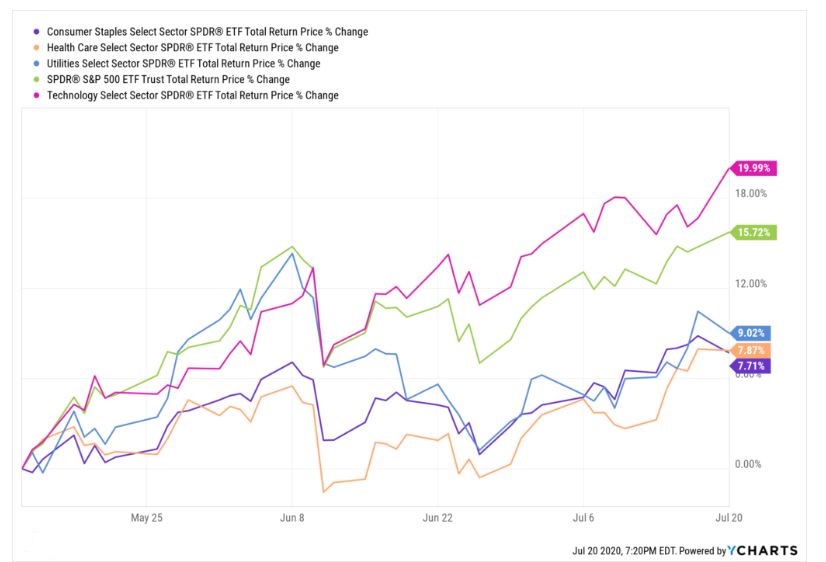

Here are what things look like today. There’s LeBron, er, the Tech sector, up about 20% the past 2 months. Just below is the S&P 500, which is being carried in large part by the Tech sector.

Team S&P 500 has some other weapons, too. The more defensive sectors of the market (Utilities, Healthcare, Consumer Staples) have recently advanced, after standing around like LeBron’s teammates when they clear out for him to take the last shot (left side of the chart above). But clearly, they are a supporting cast. I would think of it this way: the market is moving up for 5 reasons right now…and 4 of them are the Tech sector.

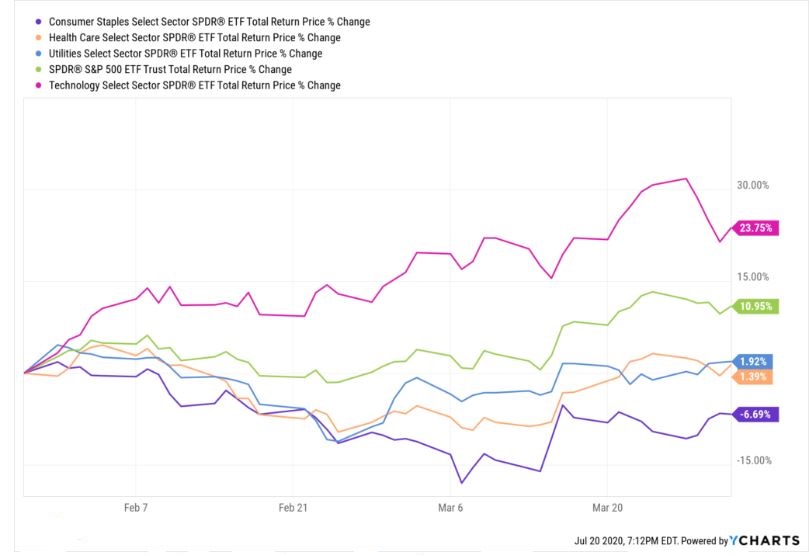

In the chart below, we take a look back to a period in early 2000 which reminds me of the current environment. There’s the Tech sector lifting the market, and there are the 3 defensive sectors just now getting into the game.

What happens next? Who knows? But here’s an educated guess. The S&P 500 continues higher, lifted by….you guessed it…Technology stocks. As we approach the all-time S&P 500 high from earlier this year, the leadership changes. Tech hits the skids, but these lagging sectors mask the drop for a while. And then it all caves in, and the bear market resumes in full force.

The information we have on our site will help you analyze this further. As for the 2020 versus 2000 comparison, here is something to remember: right after the period depicted by this year 2000 chart immediately above, the Nasdaq lost about 3/4 of its value. And the S&P 500 fell for that year (2000) and the next 2 years as well.

Regardless, our job as investors is not to predict. It is to assess, but do so considering as many angles as possible. Right now, this is one to keep your eye on.

Related: This Sector Could Be A Nasdaq-Beater. How To Size It Up