Written by: Eric Dutram | DWS

With wild market swings and broad economic uncertainty thanks to the coronavirus, some are starting to demand a bigger premium for investing in certain asset classes. This has definitely been the case for real estate, at least when considering trends in cap rate spreads as of late.

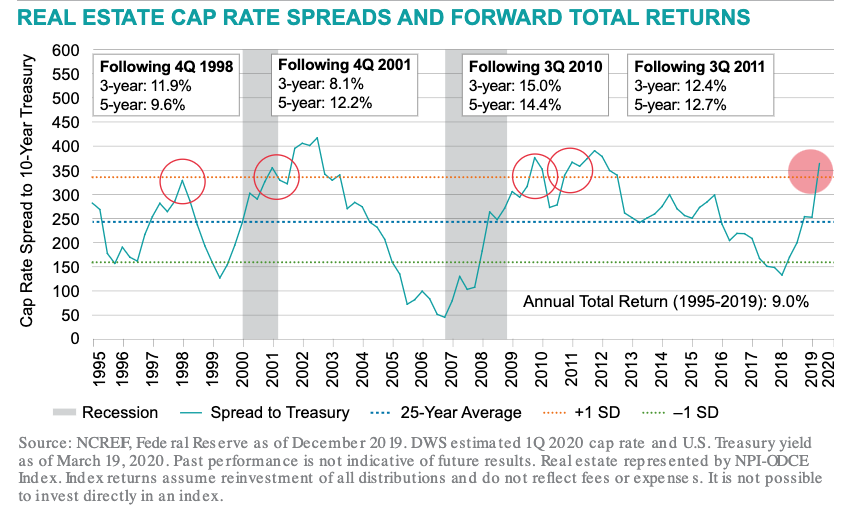

Cap rate spreads measure the rate of return expected by investors in real estate minus the 10-year Treasury yield. In other words, it is a signal of how much risk real estate investors are willing to take and at what price compared to the risk-free 10-year Treasury bond.

The long-term historical premium for this metric is right around the 250 basis point mark, but it has recently shot through the 300 basis point level, a remarkable turnaround from the start of last year when spreads were below 150bps.

This dramatic increase makes sense given plunging yields for Treasury bonds as well as the current market uncertainty. But potential historical parallels suggest that now could be an interesting time to take a closer look at real estate, in order to take advantage of a possible market dislocation (also read Real assets: A remedy for market volatility?).

Historical trends in focus

The current spread is high, but it isn’t unprecedented. In fact, in four separate instances over the past quarter century, the real estate market has breached a similar level. What is interesting about these previous occasions, however, is the performance of the broad real estate world in the subsequent years.

As shown in the chart below, after hitting the 300 basis point premium, real estate saw double digit annual returns for the coming five year period in all four of the historical examples. Furthermore, in three of the four, the three-year return average also exceeded the long run annual total return of 9.0%. Only following Q1 2001 did investors see performances that were weaker than the long-term average, and even still, a five year holding period would have corrected that problem.

Cap rate spreads to Treasuries

Large cap rate spreads have historically led to strong real estate returns

In each of the four previous situations, the elevated premium proved to be unsustainable and mean reversion eventually became the trend as the fear in the market did not last. Given the current economic environment and the hope for a recovery, it is not unreasonable to assume that we could see a similar situation out of real estate in the years ahead this time as well.

Bottom line

The coronavirus panic won’t last forever and it is hard to see the current spread for real estate cap rates against Treasury bonds lasting indefinitely at these heights either. On previous occasions of similarly elevated cap rate spreads, fear has eventually abated and strong returns were the result in all of the study periods, at least when looking at a five-year time frame.

So, while there is no telling when the pandemic will dissipate, cap rate spread trends at least suggest that now may be an interesting time to take advantage of the current fear premium and give real estate investments a closer look for the long haul (see our complete coverage of COVID-19 and investing).

Related: Opportunities for Investors in Both Public and Private Infrastructure