Last week, the Department of Labor (DOL) announced that defined contribution (DC) plan sponsors can begin to include private equity strategies in diversified investment options like target date funds (TDFs) or balanced funds. Although direct access to private equity strategies in DC plans is not yet allowed, this is a clear step towards making alternative investments increasingly accessible to retail investors. This will not happen overnight, but the investments made during the current downturn could impact investors for years to come. So what are the implications of this downturn for private equity?

Deal flow has temporarily dried up in the private equity world, but that does not mean that funds are sitting on their hands. Instead, they are taking steps to shore up existing investments, while simultaneously trying to raise capital that can be deployed in the coming quarters. Some private equity firms employ “value creation” teams that are tasked with improving the underlying business models of the portfolio companies. According to McKinsey, funds that employed value creation teams saw better returns and had more success fundraising during the crisis period than their peers.

But what about new deals? Every investor knows that the goal is buy low and sell high. Private equity funds were sitting on a tremendous amount of dry powder coming into this downturn, which coupled with the evolution of the private credit space, suggests that financing is far more readily available than was the case during the financial crisis. This subsequently positions private equity funds to take advantage of attractive valuations in a way that they were not able to in 2008. Furthermore, this extends beyond traditional buyout strategies; the past few months have seen an uptick in private investments in public equity (PIPE) deals, where private equity firms provide liquidity to publicly traded companies.

With interest rates at historic lows, and forward equity returns likely muted, investors will continue to look to alternatives for income, diversification and growth. Although public markets have rebounded swiftly, the damage being done to the real economy will lead to a plethora of opportunities for private equity managers in the coming quarters. From an access to capital standpoint, the industry is better positioned to navigate the current downturn than has been the case during prior episodes, but manager skill will still be a key determinant of any final outcome.

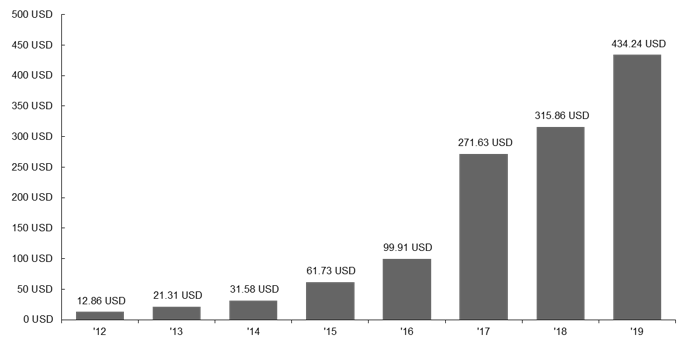

Elevated dry powder means this time is different

Dry powder by vintage, billions USD

Sources: Pitchbook, J.P. Morgan Asset Management. 2019 data is as of 6/30/19. Data are as of June 4, 2020.

Related: Will the Fed Cause Inflation?