My first job out of college was in Torrance, CA working for Toyota’s U.S. Headquarters. While I only worked there a year, I learned a Japanese concept that I will never forget. The concept is Kaizen, which means continuous improvement; and it is a big part of the culture of Toyota. Toyotas were a joke when they were introduced to the U.S. market in the 1970’s. They couldn’t even make it up a mountain and the company brought shame to many. Rather than giving up, the engineers worked hard and improved their products little by little and by the 1980’s they overtook the U.S. manufacturers for quality autos.

It has been over 20 years since I was employed by Toyota, but I still think about the concept of Kaizen. It is a great business philosophy and we are always trying to add more value than the fees we charge. 2022 was a tough year for investors. While many debate if we are in a recession or about to go into one, it doesn’t really matter. A nasty bear market is scary regardless. My biggest gripe of 2022 was actually not what stock markets did. Stocks are volatile and they are expected to have a double digit drop every year. For most of the IRAs we manage, we were overweight US stocks all year using our dual momentum strategy. The two Avantis US funds we use were heavily over-weight energy stocks, which helped a lot. Fortunately our allocation to the Avantis US Small Cap Value ETF in 2022 was down less than 5%, while the S&P 500 was down more than 18%.

What really bugged me all year was our “safe” bond funds. I was counting on these positions to be our anchor during stock market weakness like they were in 2020 and 2008. Stocks and bonds dropping together made 2022 a particularly difficult year for investors. The US Government made a terrible decision by shutting down the economy and then sending multiple stimmy checks, deferring student loan payments, giving PPP loans to businesses that didn’t need them, etc. Their partner in crime was the Federal Reserve, who printed trillions of dollars to fund the deficit. The increase in money supply brought us the highest consumer price inflation we have seen in 40 years. After calling the inflation “transitory” and leaving interest rates too low for too long, the Federal Reserve finally admitted they were wrong and we had a serious problem on our hands. As interest rates go up, the price of bonds drop and the FED destroyed my “safe” bonds. The ETF, AGG, lost over 13% in 2022. The economy and housing market have become addicted to low rates and I was surprised that the FED raised as high and fast as they did. This will eventually break something.

Typically you see investors rush into bonds when stocks are dropping and US government bonds provide needed diversification during a scare in the stock market. This did not happen in 2022. This was extremely disappointing for me. I spent much of the year thinking how much better the portfolios I manage would have performed if I held cash instead of what I considered “safe” bonds. I devoted dozens of hours to networking, attending meetings, and scouring research to try to find a better solution. I looked at timing strategies, floating rate funds, private investments, and preferred stocks. I finally decided to build a position in managed futures in the second half of the year. You can’t replace all of your bonds with managed futures–so I kept looking for something better. I couldn’t find anything worthy of my client portfolios so I had to invent my own strategy with a friend in October of 2022.

We took the principals of Gary Antonoci’s Dual Momentum and applied them to different types of bonds. As a refresher, Gary created a simple strategy where you look at the SPY ETF versus the ACWI ETF at the end of the month and you compare the trailing 12 month performance. Whichever ETF had the better 12 month performance, you hold 100% of the portfolio in the winner for the next month no matter what happens intra-month. You then evaluate which market has the momentum at the end of the next month and invest 100% of your stocks to the ETF with the momentum. Below you can see SPY (red line) has clearly had much more momentum than Foreign stocks (blue line) since the March 2009 lows. This easy to implement strategy has added some serious alpha and at some point Foreign stocks will be so cheap compared to US stocks that they will shine for years.

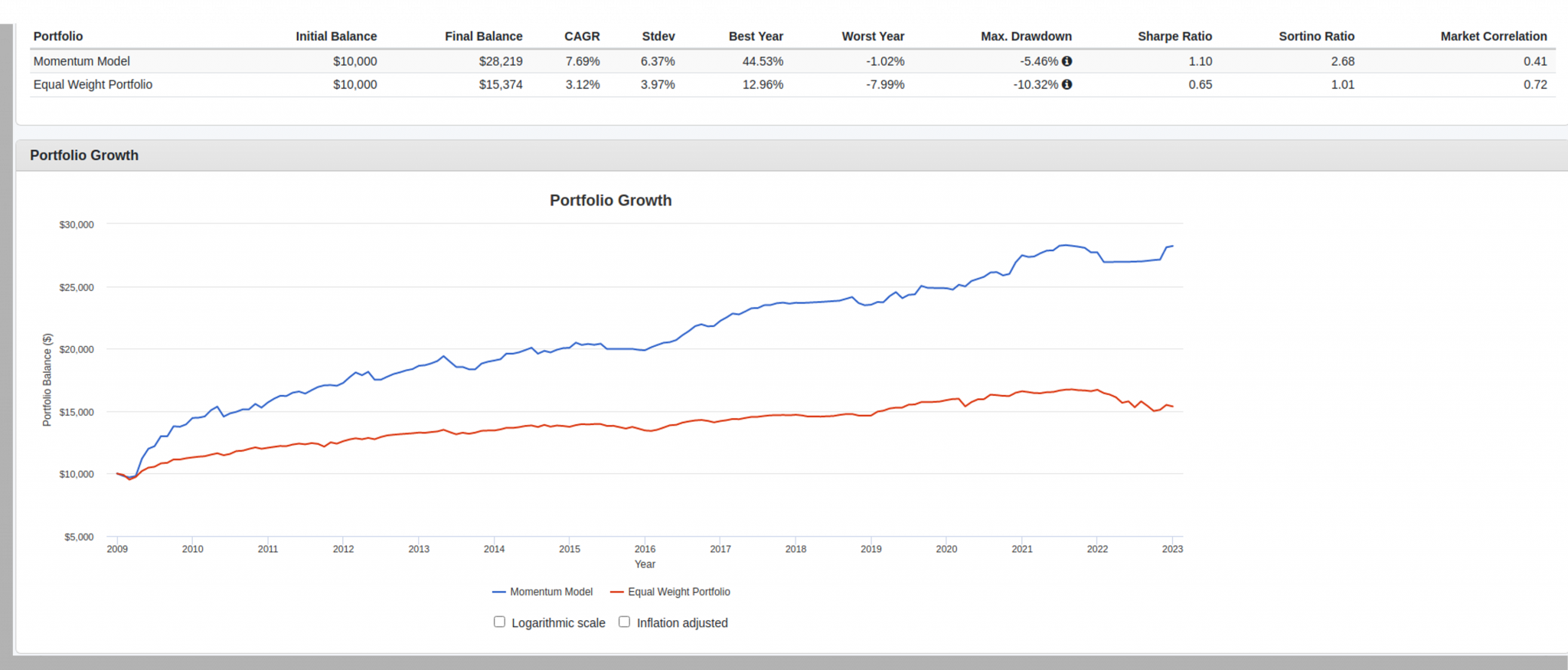

I like momentum. Trying to guess what stocks or interest rates are going to do is extremely difficult and stressful when you are wrong. A momentum strategy is instead focused on price and has you allocate to what is currently working best and eventually something else will begin to work best and you will change what you own. If it was working so well with stocks, why couldn’t it work with bonds, we thought. We back-tested many different variations of a bond momentum strategy and finally came up with something that I am confident in. Since we believe there is nothing like this on the market, I am not going to share our secret sauce. The strategy uses several types of bond funds and can invest in anything from high-yield bonds to cash. We use a certain time frame and determine which type of bonds have the strongest momentum at the end of each month. We will hold the types of bonds with the strongest momentum for the next month no matter what happens until we run the numbers again at the end of the next month. Below is a back-test of our strategy (blue line) compared to buying and holding the different bond funds equally (red line).

The first thing to note is the 7.69% compound annual growth rate (CAGR) versus the 3.97% equal weight CAGR. The maximum draw-down is about 1/2 that of the buy and hold strategy. I was looking for a strategy that could go to cash when interest rates were rising rapidly and you can see in my back-test that the blue line was flat in 2022 while the buy and hold strategy dropped a lot. The last thing I like about our back-test is that the momentum strategy moved into junk bonds in 2009 and 2020 and you can see some nice out-performance in the blue line compared to the red line (buy and hold all ETFs) below. I have never liked junk bonds as an asset class because they often act like stocks in disguise. They definitely do not provide diversification from stocks when stocks are crashing. Every five years or so they get bombed out and pay really high yields along with the chance of upside as the economy recovers. I like how my model gives me the opportunity to “rent” them and the opportunity to sell out of junk bonds when they lose momentum to different types of bonds.

I am hopeful that my momentum model will continue to add out performance with lower risk. It is important to note that a model can look great in a back test and not perform well in real life. When you back-test you are optimizing for how securities traded in the past and markets do change. Time will tell if we can bring alpha to your portfolios using momentum across different types of bonds. In the meantime, I will continue to use the principal of Kaizen to deliver more and more value.

Related: The Energy Crisis of 2022 to 2028