Written by: Acadian | Acadian Asset Management

Stimulus versus credit risk

- As central banks manage the economic impact of COVID-19 by cutting policy rates and implementing new monetary stimulus, major sovereign risk-free yields have rapidly declined.

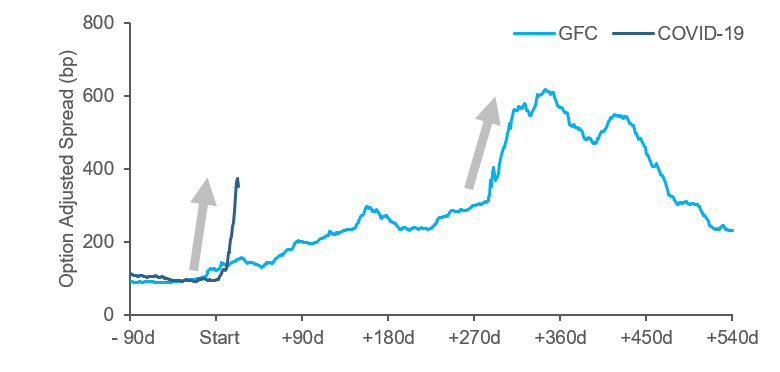

- Simultaneously, corporate credit spreads have violently widened (top chart), at a pace comparable to peak-GFC, reflective of the event’s anticipated economic impact.

Cross-asset linkages

- Our multi-asset outlook for Developed Market equities (bottom chart) deteriorated at the fastest pace since the GFC as rapidly increasing credit risk, combined with collapsing sentiment, overwhelmed the influence of falling yields.

- In the DM cross-section, rising sovereign yields of the most vulnerable peripheral European economies have put particular pressure on their equity outlook.

Looking forward

- As monetary and fiscal response takes shape, narrowing credit spreads, rising long-term yields, and continued steepening of sovereign yield curves would offer important clues about the market’s confidence in the policy response and would likely impact equities.

- Given timing differences in policy implementation and the lag between policy impulse and economic response, we expect meaningful cross-sectional variation in both sovereign and corporate credit risk and, as a result, dispersion in asset returns.

Credit spreads widen at a rate last seen close to the peak of the GFC*

Impact on equities: stimulus versus credit risk**

Related: Despite McConnell Comments, No State Bankruptcy Proposal Expected