When you’re given the go-ahead to reopen, there’s a strong likelihood that you’ll not be going back to business as usual. You’ll be facing new risks; the markets will have changed; your competitors will have changed; you may no longer have the right assets to pursue the opportunities you want; and, you may never get back to your pre-crisis operational rhythm – it will likely take you longer to get anything done.

One other significant factor; in this time of economic contraction clients are going to be more demanding, and it’s going to be harder to build, maintain, and restore their trust.

Planning for your new normal is essential. You’re going to need more than the back of an envelope, and you’re going to have to be willing to put time into its preparation. The time you put into planning is going to determine the quality of your reopening and whether you’ll be a successful first mover.

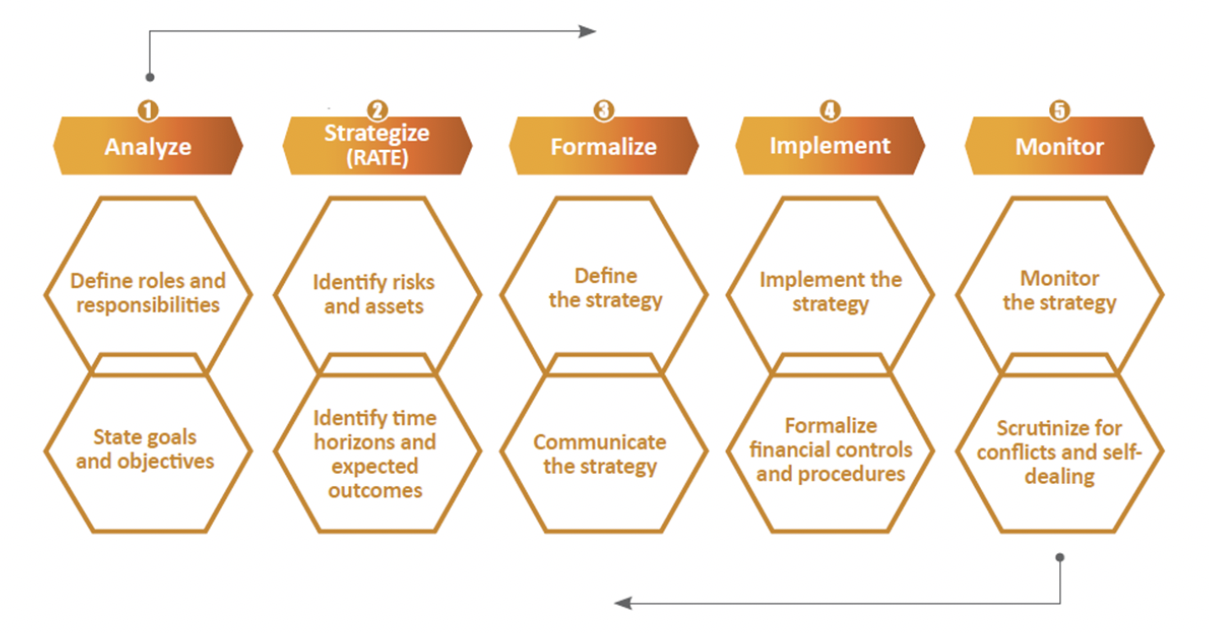

To assist you with your planning, we’ve designed a universal decision-making framework. It’s simple, which is a critical success factor when operating in a complex environment. Simplicity helps to improve communications and build trust by demonstrating that you follow a disciplined and standardized process.

There’s an additional benefit to this particular framework - not only can you use it to define your new normal, you can share it with your clients so they can use it to define their own. It’s universal, so it can be used to structure a strategy for any type of business or activity – no matter the industry sector or domain.

Also, if a client is a lay-fiduciary who’s managing the assets of a pension plan, foundation, endowment, or personal trusts, the framework can double as a fiduciary review that reinforces a prudent process.

The framework consists of five steps and ten dimensions – a dimension defines the details of a step. For each step we have prepared questions to make it easier to fill in the details for a dimension.

Step 1: Analyze

1. Define roles and responsibilities: Who will be the key decision-makers for the new normal? Did the crisis help identify new emerging leaders, or are there former decision-makers who need to be removed? Did WFH expose organizational strengths or weaknesses that will require certain staff to be reassigned? How will new regulations impact your new normal?

2. State goals and objectives: How will you define success for the new normal? Has your long-term vision changed? Do you need to rewrite your mission statement? Have you restated to stakeholders your sense of purpose and core values? What previously stated goals and objectives will you continue to pursue? If certain goals will no longer be pursued, have you notified impacted stakeholders? Where do you see new opportunities? What markets are you going to pull out of because you see diminished opportunity? Do your goals and objectives demonstrate a passion and discipline to protect the long-term interests of others? If not, rework your goals and objectives.

Step 2: Strategize

3. Identify risks and assets: What risks could keep you from reaching your goals and objectives? Are there any ways to mitigate these risks? Do you need new or additional insurance to reduce potential liability or to mitigate losses? Are you a party to any contracts or agreements that may have been breached? Do regulatory changes pose new risks? What human and financial assets do you have to work with? Do you need to expand your network of professionals and service providers? During the crisis, did you build up or lose trust credits with stakeholders and clients? How has the crisis impacted the value of your IP, goodwill, or branding?

4. Identify time horizons and expected outcomes: What is the time horizon associated with each of your goals and objectives? How will you measure successful goal accomplishment? Have you taken into account that most organizations will be operating at a much slower operational rhythm? What short-term gates have to be cleared so that you can meet your long-term goals and objectives? What third-parties do you have to rely on, and have these third-parties communicated to you their new normal and revised goals and objectives?

Step 3: Formalize

5. Define the strategy: Have you defined a strategy for your new normal that takes into account your RATE (Risks, Assets, Time horizons, and short-term Expected outcomes)? Have you created contingency plans in your strategy to account for risks and opportunities identified in Step 2? Is the new strategy flexible enough to easily adapt to those contingencies? What critical tasks need to be accomplished in order to meet the stated goals and objectives? Will you need to define new core competencies? Will you need to downsize, merge, sell, or strike new alliances or partnerships? Do you have the time, inclination, and knowledge to implement and monitor the new strategy? Is your new normal still aligned with your sense of purpose and core values? If not, rework your strategy.

6. Communicate the strategy: Have you communicated the strategy for your new normal to all key stakeholders and clients? Have you created a process so that stakeholders and clients can provide feedback on your strategy? When communicating, does your new strategy inspire and engage others? If not, rework your communications strategy.

Step 4: Implement

7. Implement the strategy: Do you have in place the right staff, technology, and resources to implement your new normal? If not, do you have a plan to acquire the staff, technology, or resources that you may need? Are your vendor relationships still intact, or do you need to establish new ones? Do you need to rewrite your services agreements? Will you need to make changes to your sales, marketing, and social media campaigns?

8. Formalize financial controls and procedures: Have you prepared a new budget and pro forma that reflects your new normal? What revenue or expense items need to be added or removed from your financial statements? Have you benchmarked your new fees and expenses against new industry norms?

Step 5: Monitor

9. Monitor the strategy: Do you have a process to periodically assess how you’re progressing towards meeting your goals and objectives? Have you defined tracking metrics that account for both performance (e.g. financial metrics) as well as effectiveness (the effectiveness of your strategy)? Do you have a defined process to periodically debrief and learn from challenges or failures? Are you revising your contingency plans as new threats or opportunities emerge? Do you have a plan to communicate progress to stakeholders? Have you increased the number of meetings you’re having with clients and stakeholders to help ease their tension and anxiety?

10. Scrutinize for conflicts and self-dealing: Do you need to prepare a new code of ethics (principles) and/or a code of conduct (rules)? If you’ve added new vendors or have reassigned staff, have you communicated your values and principles to them and scrutinized for potential conflicts of interest or self-dealing? What steps are you taking to increase your vigilance for moral hazards? Are you prepared to hold others accountable for the moral and ethical standards associated with your new normal? Can you demonstrate that you have a well-defined ethos?

A final comment; this crisis management framework also can be used to substantiate a fiduciary, governance, or project management standard. By operationalizing these steps and dimensions you’ll be able to demonstrate that you’re following a procedurally prudent process.

Your new normal is going to be anything but… better plan accordingly.