Times will get better, but on the market’s schedule, not ours

During the historic events and financial chaos of the past month, I realized something that should have been obvious. If you have experience managing other people’s money in bear markets and economic crises, the most important thing you can do is help people resist their most greedy instincts.

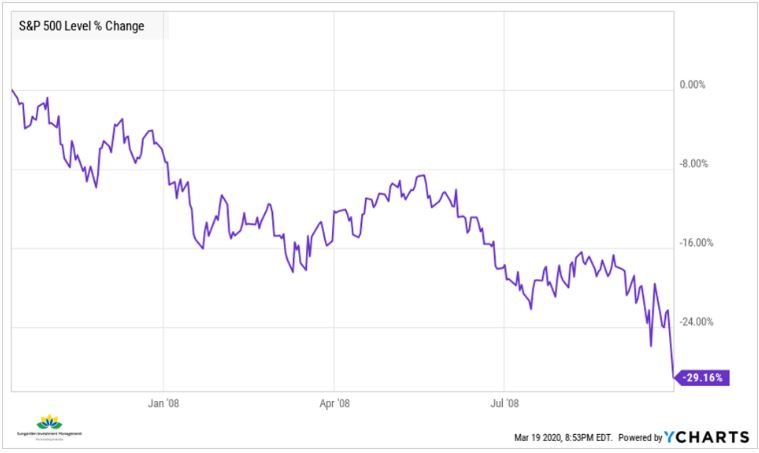

Here is the S&P 500 since it peaked back on February 19 of this year. This is through Thursday’s close. It is down about 29% in 4 weeks.

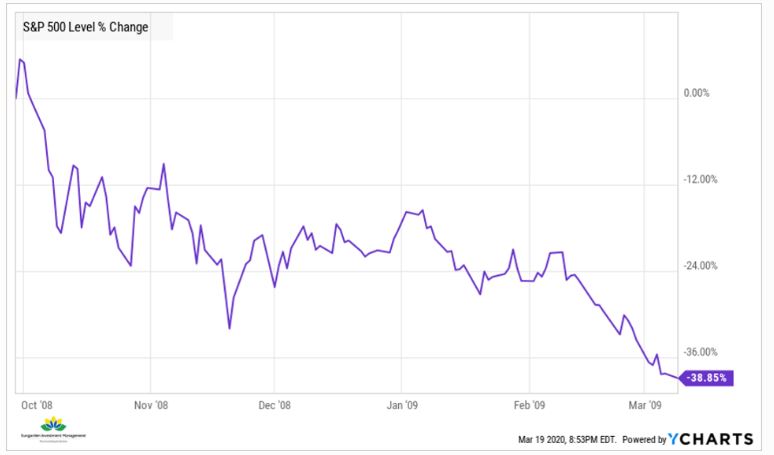

Now, here is the S&P 500 from back in the Global Financial Crisis. This was the last time the world’s economy was in total panic mode. The headline reasons were different. There was not a global health crisis. It was the reckoning of years of leverage in the financial system, and the bubble popped. This is just about the same point in the down-cycle for stocks. It just took a month this time, versus about a year last time.

Today is no different psychologically for the markets and investors. We can point to the virus as a root cause, but the domino effect in the markets (especially the bond market) looks very similar to me.

Today is no different psychologically for the markets and investors. We can point to the virus as a root cause, but the domino effect in the markets (especially the bond market) looks very similar to me.

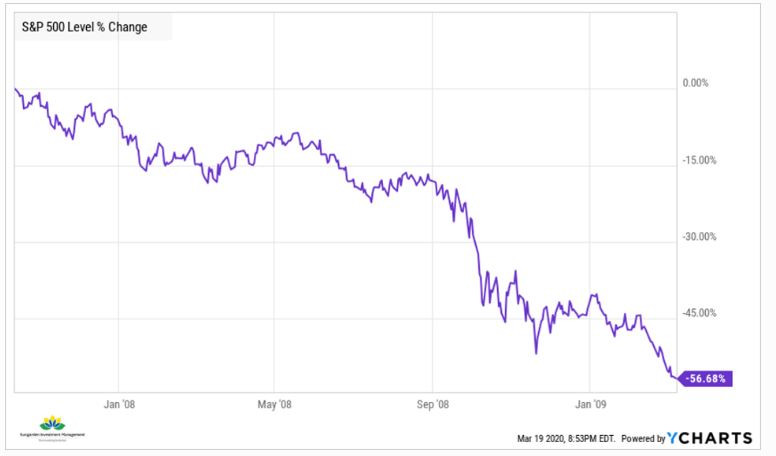

When it was all done, that 29% drop and its cousin, a 39% drop after the “29%er,” left the S&P 500 looking like this. The numbers don’t add up, right? 29 + 39 = 68%, but the chart below shows “only” about a 57% peak-to-trough decline for the stock market. That’s the math of negative returns for you. Once you lose 29%, you only have 71 cents of your original dollar left. If that goes down another 39%, you get to 43 cents left. Or 57 cents below the dollar you started with.

From this point forward, in March of 2009, the S&P 500 went on its best bull market run in recent history. And, its longest in duration. But it didn’t happen right away. There was still a lot of muck to get through. And a lot of emotion. And a lot of margin calls, hedge fund blowups, bond downgrades and bankruptcies.

I don’t know what path the bear market of 2020 will take. And in my next article (posting this Sunday), I will show you how I have been navigating it in the portfolios I manage.

For now, just keep in mind that history has a way of punishing the impatient. Don’t look at every spark of a rally as the start of the next giant bull market.

Even if it is, you will have plenty of time to get involved to the extent you want to. Prioritize your true long-term objectives for your accumulated wealth, and let that be your North Star amid the current chaos.

Related: Think Differently: How to Confront New Investor Challenges