2020 is starting to look too much like 1931 for our comfort. What to watch now.

Back in the midst of the total stock market mess that was March of 2020, I started to hear the year 1931 mentioned a lot. For a while, we were on the way to “the worst month in the Dow since 1931.” Later on, I heard 1931 mentioned in a bullish context, as in “biggest rally over (insert your favorite time period) since 1931.”

To me, 1931 had only reminded me of these things until recently:

- My late father was born in Washington Heights, NYC. He taught me to love stock charting and investing in general, so there’s that

- The Yankees didn’t win the World Series (it was the Babe Ruth / Lou Gehrig era, but the Philadelphia A’s beat them out)

- The U.S. economy was heading into the Great Depression

But all of this recent talk of the 1930s made me take a closer look at that era. In particular, I zeroed in on 1931. What I found was, frankly, one of most valuable history lessons I have seen as an investor.

Let’s consider how some of the biggest retirement-crushing market crashes played out:

In 1987 – market fell 23% in a day, 33% in a month, and then recovered fairly quickly

In 2008 – market fell 30%, then rallied as it did recently, then fell another 40%

In 1929 – the market was enjoying a nice year, then fell 25% in a week during October. It then moved sideways for a while, into 1931. Investors back then underestimated the economic climate. There was a recession, but many assumed it would pass without much further damage.

That played out OK, until 1931. Many people think the Great Depression started in 1929. As you will see, the events of 1931 were more of what pushed the global economy into that era.

1931 – nice start, but then…

1931 started out on a positive note. Then in the back half of the first quarter, it dipped, then dived quickly. That year was characterized by a few nagging factors that had built up over time:

Declining auto sales

Tariffs put on foreign goods by the United States

Falling commodity prices

A surge in consumer debt, thanks to easy credit

Bank failures, due to loan defaults resulting in part from those years of easy credit

A dive in the Federal Funds rate down to 1.5%

More bank failures, including a gigantic one in Germany

Deepening fiscal deficits around the globe

A dominant victory by the U.K.’s Conservative Party over its Labour Party

A deflationary spiral

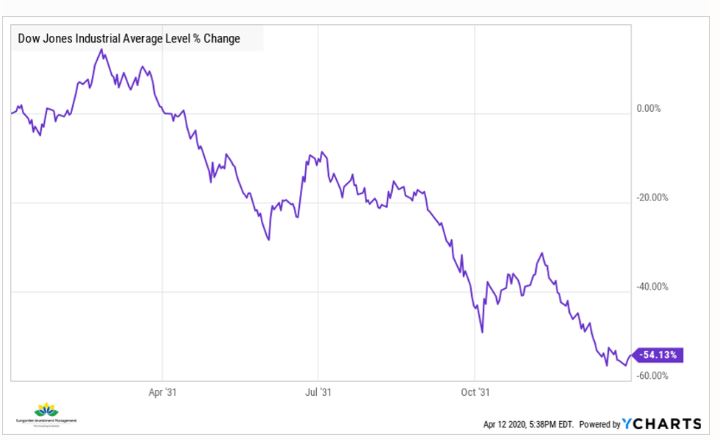

The chart above shows what happened in market terms. The S&P 500 did not exist back then, but the Dow Jones Industrial Average did. And it was considered “the market” to U.S. investors.

The positive start to the 1931 stock market quickly faded. From late February until early June, the Dow fell 37%. Then, it rallied by over 25% in just a month’s time, and got within 9% of where it had started the year.

Then, as iconic NYC sportscaster Warner Wolf used to say, “you could turn your TV sets off right there.” Except this was about 15 years before television existed.

From that point forward (early July, 1931), the stock market was one bullish nightmare after another. A 13% dip was followed by a very brief, sharp rally. Then, another 5-week drop of 38% during September and early October.

The final rally

A 35% rally followed (of course it did, this was crazy 1931!). It took all of 5 weeks, and still left the Dow off more than 31% year-to-date through early November (my Dad was born right around then, but that is not really part of the story).

Finally a 37% plunge in 6 weeks, ending on December 17. The Dow didn’t move much during the last 2 weeks of 1931. Mr. Market was probably unconscious by that point.

The final tally

The Dow’s return for the full year 1931 was a loss of 54%. After all of the sharp drops and faith-restoring rallies that occurred that year, an index investor (not that it was a “thing” back then) would have seen their portfolio more than cut in half.

The aftermath

Did this create some kind of “generational buying opportunity?” Was it time to “go all in” as at least one non-professional market commentator announced about a month ago? Was buy-and-hold investing born right as 1931 ended? Answers: no, no and no.

As the chart below shows, the Dow regained the level it had sat at as of January, 1931. That break-even moment occurred in 1937, 6 years later.

The economic shock of the late 1920s and early 1930s presented two types of opportunities for investors: they could get more in sync with the new, inherent volatility of the stock market, which accompanies all periods of economic turmoil. Or, they could just buy-and-hold-and-hope.

The buy-and-hold types saw plenty of thrills and just as many disappointments. As you can see, the mid-1930s were pretty amazing, for the most part.

The market regains its old 1931 peak…a generation later!

However, the ups and downs did not produce sustained growth above that January, 1931 “high-water mark” until much later. Correction: much, much much later. 1954 to be exact. 23 years, and the Dow’s price was the same as it was in 1931. Oh, there was some dividend yield to earn during that time, but it was a pittance compared to the capital losses.

How does 1931 help us understand today’s markets?

Severe declines in the value of your portfolio are not something you should just hope you can avoid. You need to be proactive about preventing them. They CAN be prevented, if you understand the tools and techniques modern markets make available to us. This is something that every day investors did not have available in the 1930s, and not really much more in the 1980s. But today, just as there are a zillion ways to seek reward, there are many ways to protect it. And stuffing your cash under a mattress is not what I am talking about.

Big drops in your portfolio value are not the same as small ones. When you lose 20% or more in one shot, your climb back is not only difficult mathematically (it takes 25% to break even after a 20% loss, and 40% loss requires a 67% gain to return to where you started). Investing depleted wealth is a staple of bear markets. Don’t let it happen to you. And, if it just did happen to you, don’t let it happen again. My number one investment rule has always been pretty simple: avoid the big loss (thanks to my late father, child of the 1930s, for that one!).

The growing possibility that history is repeating itself

You see, the conditions that led to 1931’s market turmoil are not just things I plucked out of a textbook. Nearly all of them could be used to describe the markets of the last couple of years.

No, we did not have a recession until the one that clearly just started. However, the reason we didn’t probably has a lot to do with suspending the inevitable. The Fed and other central banks made credit too easy for too long, and drove too much capital toward the stock market. That made everyone think it was easy.

Modern financial engineering pulled years of future stock market and bond market returns forward. That’s the bottom line. Not recognizing that puts you at risk of being like the person who didn’t see their text that said the location of the party had been moved across town…back when we did that sort of thing.

However, the rest of the items on that list are strikingly similar to the environment from 1931. And so far, the stock market’s movement this year is way too similar to simply pretend it isn’t happening.

We all hope that world economic conditions improve, and as quickly as possible. But hoping is something we should reserve for non-financial matters. When it comes to your money, hope is not a strategy.

And, space prevents me from listing many more. The best response for you: understand what is possible, get educated about it, and make a concerted effort to identify the not-so-obvious risks in your portfolio. That would include things like lower-quality bonds, misleading fund names, and financial pundits who seem to be speaking from a script.

So now, 11 years removed from the last time all of investors’ worst inclinations (complacency, greed, being frozen and not doing anything but hope it passes), are all in play again. I see and hear it every day in the reams of market opinion, anecdotes and conversations I have with folks that have not been conditioned to think about risk management in a way that can prevent making a mess out of years of hard work toward retirement. And that brings us some pointed conclusions.

1931 – key lessons for today’s investor

- Net-net, I have found that the best way to pursue the type of returns most retired or nearly-retired investors desire over long periods of time is NOT to invest aggressively. It is not about having a 60%/40% (stock/bond allocated) portfolio. And it not being 90% or more invested in index funds.

- The key to retirement investing is to understand the vicious cycles that are inherent in investing. Those cycles are less about the current news, and more about the buildup of excesses in the financial system. They are about red flags being ignored, or even mocked, as if the proverbial frog in the boiling pot of water is looking up and you and shouting “your investing returns stink” because you didn’t do better than index fund investors during the best up years.

- If you pursue a path that aims to keep your portfolio’s value within striking distance of its peak at all times, and get a decent share of the best markets, you have a strategy that will keep your emotions at bay. And, if you keep a laser-focus on your specific, personal investment objective (e.g. what defines a successful outcome to you), your chances of getting there go up dramatically.

- In today’s market climate, if you are trying to get to retirement or stay retired, investment returns need to be engineered. During the last decade, you could get away with just hoping that the stock market went up. If you continue using that philosophy, it might work out. But more likely, you will threaten all you worked for.

The great news: it is within your control. If only people had today’s perspective and tools to navigate the stock market’s gyrations way back in 1931! For their sake, in addition to your own, take advantage of what history has taught us about the threats and opportunities available to every investor.

C’mon Isbitts, 1931 is ancient history!

I am certain that many who read this article will quickly dismiss it, the same way they dismissed concerns about a 1987-style crash, a return of 2008-like economic conditions, or a slide in stock prices a la the Dot-Com Bubble. As I see it, today’s crazy and strange market environment is borrowing something from each of those pieces of stock market history.

However, the period that I think informs us best about how to balance reward and risk, the benefits of portfolio hedging, and use of tactical investment strategies is…you guessed it…1931. Because investing is not a 1-year event, but enough can happen in one calendar year to change your financial fortunes for a generation.

I know what you are thinking: there was no equivalent of COVID-19 that impacted the stock market in 1931. However, today’s market woes are made much worse by the conditions that existed going into 2020.

Many of those same conditions were present in the period that led up to 1931’s financial debacle. That is why dismissing the recent market decline as simply a blip caused by a virus is cheating yourself out of the perspective you really need to assess the range of future possibilities for your wealth.

This is not some kind of sensationalism. It is an alarm bell to get more familiar with your surroundings, in an investing and historical sense. I hope this history is something you can learn from, and use to build a bridge to a more confident portfolio and retirement investing plan.

Related: Shaving My Head Was An Experience Investors Can Learn From