Written by: Richard Grasfeder, CFA | Boston Private

Expect Volatility to Continue

In Short

- Sentiment drove much of the market volatility in March

- Fundamentals will matter again, but …

- We need to narrow the range of earnings estimates

Equity Market Review

The first quarter, and specifically the month of March, proved much more volatile than we expected. Now that little value exists in most economic and market indicators typically used to forecast and evaluate the equity markets, we want to briefly outline how we are looking at the current environment.

First, we believe a slowing in the spread (i.e., slowing case rates) of COVID-19 will need to occur before equity markets can move sustainably higher. This appears to be occurring now, and in early April, equities have staged a significant recovery. The next step will be a lifting of mobility restrictions without a resurgence in case rates. This will be closely followed by how quickly economic activity rebounds to 2019 levels. Significant uncertainty exists regarding the timing of these events with estimates ranging from months to years.

Since 1926, the S&P 500 reached new high water marks 3-4 years following a negative return for a calendar year-end. The outliers were years when the equity market was overinflated, such as the Great Depression, Tech Bubble and Financial Crisis. Hence, buying the S&P 500 at or below 2,500 would provide about a +9% annualized return if the S&P 500 exceeds its 2019 close of 3,231 in three years. This is above our forecasted 10-yr average return, and is a solid return. This rationale is likely driving some of the buying currently moving the market higher.

Our concern is that earnings estimates need to come down significantly, and this realization has the risk of taking equities lower in the near-term as stocks usually follow earnings. Many equity investors are looking past 2020 earnings towards 2021, which is not an easy forecast. Following 2019 S&P 500 earnings of $164, a 30% decline in earnings in 2020 is $115. A 30% increase in 2021 is $150. An average 1-yr forward P/E multiple of 16x $150 results in 2,400 for the S&P 500.

The difficulty is that sentiment could take over again, this time in a positive way, as investor mindsets shift from “it will get worse” to “it will get better, even if I don’t know when.” Sentiment could cause equities to trend sideways, or even rise, as investors look past expensive near-term valuations and take a longer term view.

Sector Analysis

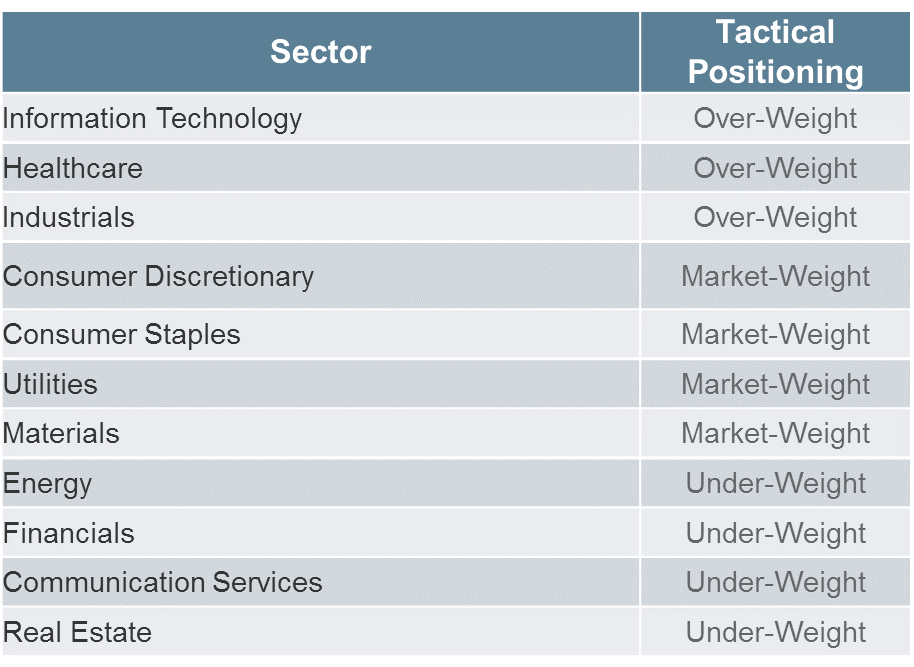

From a sector perspective we favor technology, health care and are becoming more positive on industrials. Technology continued to outperform during the quarter, benefiting from the “shelter-in-place” remote work environment, and distributed work forces. Additionally, many technology companies have substantial cash balances, relatively low debt, high recurring revenue, and high margins.

Health care was already regaining favor before the coronavirus outbreak for its attractive growth rate and oversold valuation. Health care has a chance to emerge from the outbreak with a better public image as many companies have rallied to fight the virus. The sector should remain more resilient during the likely pending recession. However, if the virus exerts a sustained impact on the economy with significantly higher numbers of unemployed, uninsured, or underinsured patients, this could be a headwind to health care demand.

Industrials had been challenged by U.S.-China trade tensions prior to the pandemic, and customers may cut back on capital expenditure near-term to conserve cash, negatively impacting industrial end market demand. This is usually the time to buy into the sector, particularly the cyclically exposed companies that have sold off, but still have solid balance sheets to allow them to survive.

We are neutral on consumer discretionary and staples. Consumer discretionary is primarily being driven by Amazon which represents almost 40% of the sector. Sector breadth is weak as most other retailer, restaurant, auto, travel, and leisure stocks have been hit hard as businesses have been forced to close. However, this will likely provide opportunities to invest in the survivors.

Consumer staples are traditionally used as bond proxies due to high dividend yields and frequent downside protection during market volatility. The sector benefited from increased consumer demand due to stay at home orders, with the sector providing a strong performance in Q1. At this point we believe more upside is available in other sectors.

We are underweight energy, financials, and communication services. Energy stocks will continue to be volatile with the price of oil and natural gas falling to multi-year lows. Without production cuts from OPEC+ and an improved demand environment, oil prices are unlikely to move materially higher, causing sector headwinds. With the sector now less than 4% of the S&P 500, investor interest continues to wane.

Financials remain challenged given that two of financial companies’ primary earnings drivers, interest rates and asset prices, have been in freefall due to the global shutdown. Insurance has outperformed while banks lagged as the yield curve flattened. Additionally, it may take several quarters for second derivative risks to become apparent, such as the severity of unemployment, bankruptcies, and duration of low interest rates.

Finally, communication services is a challenged sector, as many telecommunications, entertainment, and media stocks face challenging industry and/or company fundamentals that include slower growth, higher costs, and increased competition. Alphabet and Facebook (non-dividend payers) constitute ~50% of the sector and continue to drive most of the sector returns. However, these two stocks may have some near-term headwinds given reports of significant advertising spending reductions.

Looking Forward

We expect volatility to continue in the equity markets as the economy restarts, though hopefully not to the same degree as in Q1. We believe investors with long-term time horizons will have opportunities to find value in individual stocks unfairly sold off on short-term fears. While near-term market moves remain challenging to predict, we do believe increasing equity exposure below 2,500 on the S&P 500 should provide solid returns for investors with longer time horizons.

Related: The Great Run of the S&P 500 Bulls

DISCLOSURE:The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.