Written by: Robert Serenbetz | New York Life Investments

The Democratic and Republican national conventions have officially wrapped up, but an uncertain election outcome persists. So far, markets have largely ignored election proceedings and changes in polling. Investors should prepare for potential election related volatility by rebalancing, broadening equity exposures, and building a cash position.

As we noted in our recent piece, Navigating the 2020 election. A Democratic sweep would bring the most policy change. Taxes, regulation, immigration, healthcare, and trade could all see changes.

We expect, then, that any increase in the likelihood of a Democratic sweep could increase the market impact.

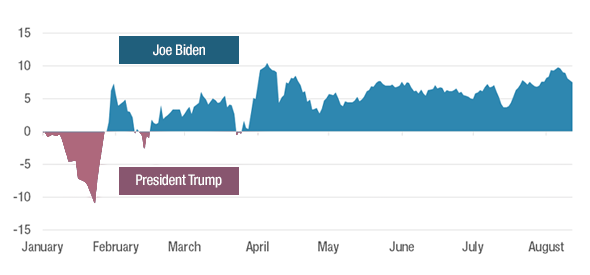

Where do we stand now? Earlier in the summer, national polls have suggested a commanding lead for Democrats (figure 1). But Joe Biden’s lead has narrowed – a reminder that nothing in politics is certain. A lot can, and likely will, happen in the next two months that could change the odds.

In addition, we are wary of the polls’ predictive power. For one, a bias in polling, as seen in 2016, may be just as prevalent today – particularly in key battle ground states where the election outcome is already less clear. Second, the pandemic will likely impact voter turnout in unforeseen ways including potential voting disruptions. The ideological split over voting by mail could further lead to operational issues or a contested election beyond election day. In these circumstances, we would expect volatility to rise, risk assets to sell off, and the U.S. dollar and other safe haven assets to rally.

Presidential General Election Polling

Source: New York Life Investments Multi Asset Solutions Team FiveThirtyEight Data. As of 9/3/2020. Polling represents a simple weighted average of various general election polls.

Many of the most important factors for the election and the markets are out of the candidate’s control, such as like the path of the pandemic, a vaccine, and the shape of the economic recovery.

Still we suspect that most investors ill-positioned for the impending uncertainty. Equity markets have moved notably higher in recent months, despite a recent setback, which likely contributed to significant portfolio drift. Investors should consider portfolio rebalancing to correct for that. Investors could also consider building a cash position to take advantage of market opportunities, broadening sector and asset class exposure moving beyond Large Cap US technology stocks, and adjusting expectations for future market returns.

Related: Investors Views on the Election and the Stock Market

Related: Will Voting by Mail Be Accepted?