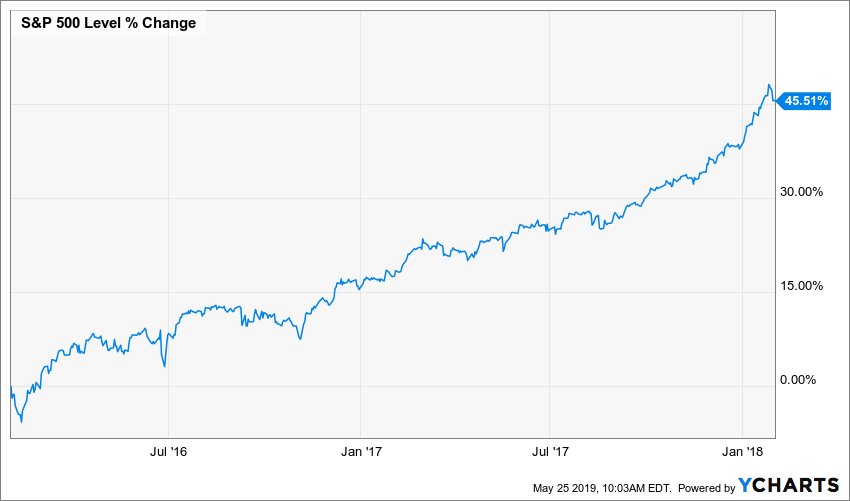

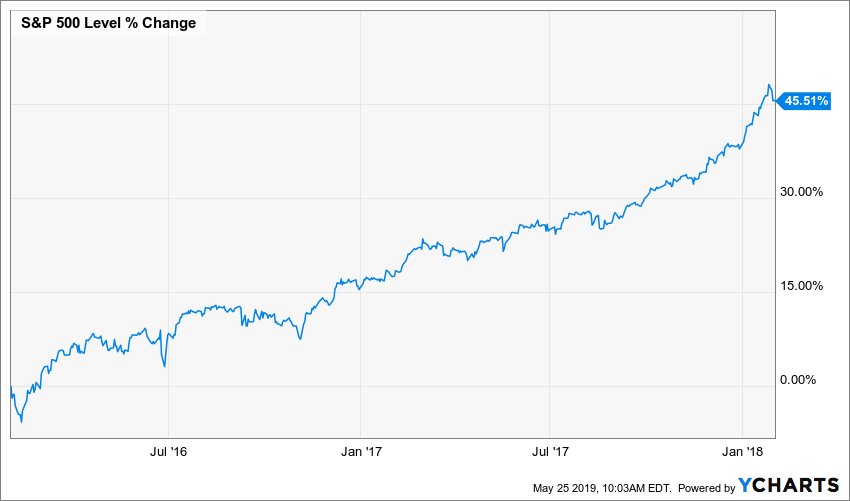

Legend has it that a young man ventured to inquire J.P. Morgan’s opinion as to the future course of the stock market .The alleged reply has become classic: “Young man, I believe the market is going to fluctuate.” From February 2016 until February 2018 the market violated that theory, rising 45% with very little fluctuations.  Since then the market has fluctuated quite a bit , but hasn’t gone anywhere.

Since then the market has fluctuated quite a bit , but hasn’t gone anywhere.

The fluctuation continued last week, as the S&P declined 1.17%, marking the third consecutive week of losses. Unless you are a Golden State Warrior fan, it’s hard to find any good news. Relationships between China and the U.S. appeared to deteriorate further, as the Commerce Department blacklisted telecom giant Huawei Technologies from buying U.S.-made components. Tech stocks responded by selling-off over 3%, and are now down over 7% for the month of May. Copper prices, often viewed as an indicator of manufacturing activity, have fallen almost 9% in the same time frame. The yield on the Ten-Year Treasury reached 2.29%, its lowest level since September 2017.Crude oil prices fell 6% during the week and are down 8% MTD. On the earnings front, with 97% of S&P 500 companies having reported first quarter results, composite earnings have declined 0.4% on 5.3% revenue growth.In late April, hopes for a major stimulus program blossomed, with both Trump and Democrats saying the two sides agreed that an infrastructure package would need to contain about $2 trillion in funding and investments. On Wednesday, President Trump walked out of the meeting that was supposed to be the second official sit-down between the president and Democratic congressional leadership specifically focused on infrastructure, telling reporters moments later that he would not negotiate on legislation with Democrats while he was still under investigation by several committees.In the U.K., prime minister Theresa May announced that she would quit once her Conservative Party chooses a successor, putting the prospect of a disruptive no-deal exit from the EU back on the table.If one were to try to put a positive spin the previous paragraph, the focus would be on how expectations are quite negative, which opens the door to positive surprises. After all, the news flow, like the stock market, also fluctuates.

This Week:

The markets were closed on Monday in observance of Memorial Day. Tuesday, the Conference Board releases its Consumer Confidence survey for May. Despite all the downbeat headlines, economists forecast continued optimism from the consumer.The two big releases of the week both come on Friday with the Institute for Supply Management’s Chicago Purchasing Managers’ Index for May and the Bureau of Economic Analysis’ PCE deflator. The former is expected to rebound from April, while the latter is anticipated to indicate a subdued level of inflation.The market moving tweets are almost certain to continue.Related:

Just Another Manic Monday Stocks on the Move:

Orion Energy Systems, Inc. (OESX) +43.95%: Orion is a developer, manufacturer, and seller of lighting and energy management systems. The Company announced that it has received a commitment to expand the retrofit of a major, unnamed national account customer’s lighting systems with LED lighting and wireless IoT enabled control products, totaling an additional revenue of $64 million under the next phase, which is dependent on the customer’s issuance of purchase orders. Installations for the expanded phase are slated to begin in Orion’s Q2 in fiscal 2020 ending Sept. 30 and are to be completed during its fiscal year ending Mar. 31, 2020. This expanded phase builds on both an $11 million letter of intent and a $35 million contract previously announced, bringing total anticipated LED lighting installation revenue from the customer to $110 million. Wow. There are a lot of other legacy customers that might have similar sized programs on the drawing board. OESX is a 2.80% holding in the North Star Opportunity Fund and a 1.21% holding in the North Star Micro Cap Fund.

Target Corporation (TGT) +15.07%: With 1,844 stores (as of the end of fiscal 2018), Target is a leading American general merchandise retailer, offering a variety of products across several categories, including beauty and household essentials (24% of fiscal 2018 sales), apparel and accessories (20%), food and beverage (20%), home furnishings and décor (19%), and hardlines (17%). JPMorgan analyst Christopher Horvers upgraded Target to Overweight from Neutral, and added $19 to his price target, to $100. He argues that the shares are undervalued and could surpass consensus estimates. “We believe it should revalue towards the best-in-class Amazon-safe bucket,” he wrote. What pushed him into the bull camp was the company’s first-quarter earnings results, which showed market-share gains in home and apparel (categories where same-stores sales growth was about 3% and 5%, respectively). The company’s gross margins also improved while cost controls remained strong. TGT is a 1.73% holding in the North Star Opportunity Fund.

Consolidated Communications, Inc. (CNSL) -11.79%: Consolidated Communications Holdings Inc provides communication services for business and residential customers across 23 states in the U.S. through its network with more than 37,000 fiber route miles. What a mess. The Company’s history dates back 125 years, of which the first 123 years were rewarding for shareholders. In July 2017 the Company acquired FairPoint Communications and the pain for shareholders commenced. In hindsight, that acquisition redefined Consolidated from a stable dividend oriented enterprise to a heavily leveraged growth company. It may prove to be a brilliant transformation, but not for their entire base of shareholders who owned the stock for its long history of dividend stability. The shares have now declined over 50% since the Board of Directors made the foolish decision to eliminate the dividend following their first quarter earnings results, essentially forcing their previous shareholders to liquidate their holdings. The business results modestly exceeded expectations and there has been no incremental news since. The dividend irrelevance theory created in 1961 by Modigliani and Miller would suggest this reaction to the dividend elimination is an aberration. Time will tell. CNSL is a 0.86% holding in the North Star Dividend Fund and a 1.10% holding in the North Star Opportunity Fund. CNSL corporate bonds are a 2.90% holding in the North Star Bond Fund.

Boot Barn Holdings, Inc. (BOOT) +14.2%: Boot Barn Holdings Inc operates specialty retail stores. The company sells western and work‑related footwear, apparel and accessories in the United States. The Company’s shares rebounded from their curious decline following a very strong earnings report the previous week. BOOT is a 4.08% holding in the North Star Micro Cap Fund.Portfolio holdings are subject to change and should not be considered investment advice.North Star Investment Management Corp. is the Advisor for the North Star Family Mutual Funds.

Since then the market has fluctuated quite a bit , but hasn’t gone anywhere.

Since then the market has fluctuated quite a bit , but hasn’t gone anywhere.