Markets are adding to yesterday’s gains on the back of former Treasury Secretary Steven Mnuchin restoring confidence in the regional banking sector. He and his team, which also includes former Comptroller of the Currency Joseph Otting, are working to rescue New York Community Bancorp (NYCB). It is raising confidence that acquisitions across the regional banking sector may insulate the economy from financial instability. Against this backdrop is the second day of Fed Chairman Jerome Powell’s testimony to Congress, which features much of the same content from yesterday: the central bank needs more conviction that inflation is moderating before it begins to reduce short-term interest rates. Indeed, the Canadian and European Central Banks agree with the overall macro picture, as both parties decided to keep their rates unchanged this week to avoid a resurgence in inflation. The Bank of Japan, meanwhile, is expected to raise rates for the first time since 2007 and into positive territory later this month, following strong wage and inflation numbers. Expectations of a rate increase are leading to a stronger yen, a softer dollar, and weaker Japanese equities.

Slow Hiring, Slow Layoffs

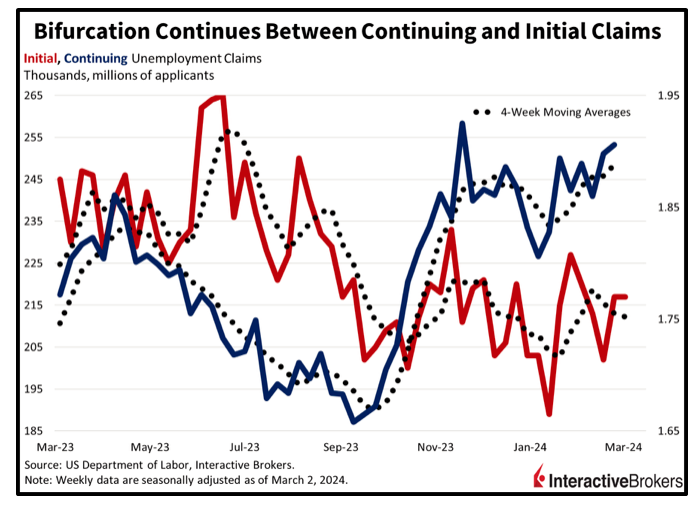

Unemployment claims remained virtually unchanged during the past two weeks as the bifurcated trend between initial and continuing unemployment claims continued. Consistent with the decline in job openings, it is taking longer for laid-off workers to find new jobs; however, the overall level of layoffs has remained muted. This development is driving the trend of initial claims lower but continuing claims higher. For the week ended March 2, initial unemployment claims of 217,000 marginally exceeded estimates of 215,000 and were unchanged from the prior period. Continuing claims rose above the pivotal 1.9 million level to 1.906 million during the week ended February 24, exceeding projections of 1.889 million and the previous week’s downwardly revised 1.898 million. Without the revision, the period would have marked the second consecutive week above 1.9 million. The four-week moving averages for initial and continuing claims shifted from 213,000 and 1.878 million to 212,250 and 1.888 million during the period.

Retailers Feel Brunt of Softening Consumers

Retailers are continuing to streamline their operations, trim inventory and cut prices in response to consumers struggling with challenging economic conditions. Those were a few themes found in the following quarterly earnings calls:

- American Eagle posted fourth-quarter results that beat the analyst consensus expectation for revenue and earnings after adjusting for one-time expenses and its revenue climbed significantly year over year (y/y). The company’s increase in sales was driven by strong demand from holiday shoppers, reduced input costs, and unlike many other retailers, smaller price markdowns. On a non-adjusted basis, the company’s earnings dropped significantly y/y, a result of a $98.3 million impairment charge for its Quiet Platform, a logistics operation. The charge included severance costs for Quiet Platform employees. The company’s guidance for mid-single-digit percentage sales growth for the current quarter met expectations. Among other initiatives, it plans to continue building its American Eagle brand, reduce its assortment of products, and improve operational efficiency.

- Big Lots cited a challenging macroeconomy and adverse weather in January as headwinds to its performance during its fiscal fourth quarter that ended February 3. After accounting for costs attributed to closing a distribution center and other impairment charges, the bargain retailer produced a loss of $8.3 million compared to an $8.1 million loss in the year-ago quarter. Its revenue declined y/y but met expectations while earnings missed. During the fiscal year, the company eliminated $140 million in selling, general, and administrative expenses and reduced its capital expenditures by 160%. It also reduced inventory by $200 million. For the current quarter, Big Lots expects comparable sales to improve from the last quarter but still decline on a y/y basis.

- BJ’s Wholesale Club beat earnings expectations but fell short of revenue estimates during its fiscal fourth quarter. Both metrics grew y/y, but the company said the macro economy is challenging and provided disappointing guidance. In the recent quarter, comparable sales excluding gasoline increased 0.5% y/y, a result of increased traffic to its stores. BJ’s expects comparable sales for the current fiscal year to increase from 1% to 2% while analysts expected guidance of 1.6%. However, its earnings guidance fell within the bottom range of analysts’ expectations.

- Kroger posted a 6% increase in sales driven by more customer visits and generated revenue and earnings that grew y/y but only narrowly exceeded expectations. When excluding gasoline sales, same-store sales dropped 0.8% while digital sales climbed 10%. Kroger said customers are increasingly managing macroeconomic pressures, causing the company to reduce prices and increase personalized promotions. Its earnings per share guidance for the current fiscal year fell below analysts’ expectations.

Relief Rally Produces Broad Gains

Markets are higher with all major US equity indices trading loftier as the risk of banking contagion related to NYCB appears to have diminished. The Nasdaq Composite is leading with a gain of 1.2%. Other leading benchmarks include the Russell 2000 and the S&P 500, with both advancing by 0.9%, and the Dow Jones Industrial, which is up 0.6%. Sectoral breadth is terrific with all segments higher. Materials, with a gain of 1.5%, is leading followed by energy and technology, which are both up 1.2%. Yields are near the flatline as the 2- and 10-year Treasury maturities trade at 4.54% and 4.11%. The dollar is down on the back of a strengthening yen as odds of 80% favor a rate hike at the Bank of Japan’s meeting in less than two weeks. The greenback’s index is down 36 basis points to 102.98 as the US currency loses ground relative to its major developed market contemporaries including the euro, pound sterling, franc, yen, yuan, and Aussie and Canadian dollars. Crude oil is down as major central banks around the world are not yet ready to begin easing policy, which is contributing to a softening demand outlook. WTI crude is down 0.9%, or $0.69, to $78.37 per barrel.

Bank Risks Linger While Monetary Policy Remains Uncertain

Overall, NYCB has over $100 billion in assets, of which a large portion are rent-regulated apartment buildings and office buildings. While a $1 billion cash infusion from Mnuchin and his team certainly helps the financial condition of the institution, it remains a very small share of NYCB assets and doesn’t eliminate possible systemic risks stemming from further regional bank stress. Indeed, the FDIC just added eight banks to its problem bank list, as commercial real estate and consumer loan defaults mount. Central banks, meanwhile, are increasingly shifting toward cutting rates later rather than sooner. The next five days are likely to shape investors’ outlook for monetary policy further, with nonfarm payrolls and CPI arriving tomorrow and next Tuesday with significant implications for the Fed’s Summary of Economic Projections. That will be released on March 20. Cool figures will prop up rate cut expectations while hotter numbers will incrementally delay the Fed’s next move, augmenting our journey across the monetary policy bridge.