The key to investment performance is being skeptical of the crowd

The stock market is a knucklehead. You heard me correctly. The S&P 500 Index and the stock market are acting erratically. Moreover, they are as indecisive as I have seen in over 30 years of watching them.

Now, you can understand why this is the case. The future is one big uncertainty, economically and in general. That makes this a time to be very deliberate in each financial action you take.

Risk off? Hardly.

Despite this situation, there is still a strong feeling among many investors that the “big risk event” is off the table. It is as if we all know that a 30% decline like the one we had a few months ago is the only one allowed in the decade of the 20’s. So, it follows that we have another 10 years of bliss due, right?

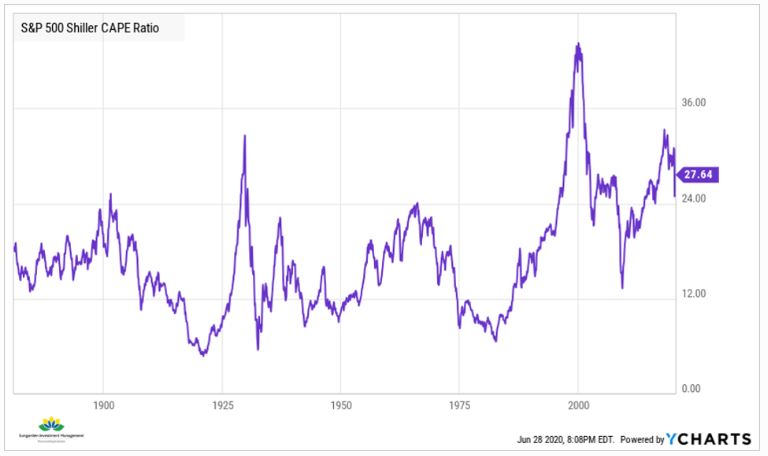

This is not the case. I can’t predict the future, and I don’t try. But I can estimate when risk is high, and it is. That’s what the chart above shows us.

A man with a CAPE

That’s the CAPE Ratio, created by Yale Economic Robert Shiller. It smooths out the earnings of the S&P 500 companies over many years, and factors in inflation. The result has been a very good predictor of when stock market risk is abnormally high.

The CAPE stood at 27.64 times earnings at the end of April. And with the market a few percentage points higher since that time, and S&P 500 earnings crashing, the CAPE might just be on its way into the 30+ range again.

Why does that matter? Because CAPE is already coming down from the level it reached at the crash of 1929. And sure enough, we had that first quarter meltdown.

The only other spike to this level was in the year 2000. That started 3 years of S&P 500 decline. In a row. And a nearly 50% peak-to-trough drop.

Mistaken identity can be hazardous to your wealth

In other words, please don’t underestimate the risk that still exists in the stock market. Do not treat it like it’s something more sophisticated than it is. What we are seeing this year is more about animal spirits than an aristocrat.

In other words, the market is not a noble being. More than ever, it is a flurry of digital whims by factions that do not care what they are investing in. It is a market laden with greed, at the expense of rational thought.

Even “real” aristocrats are vulnerable

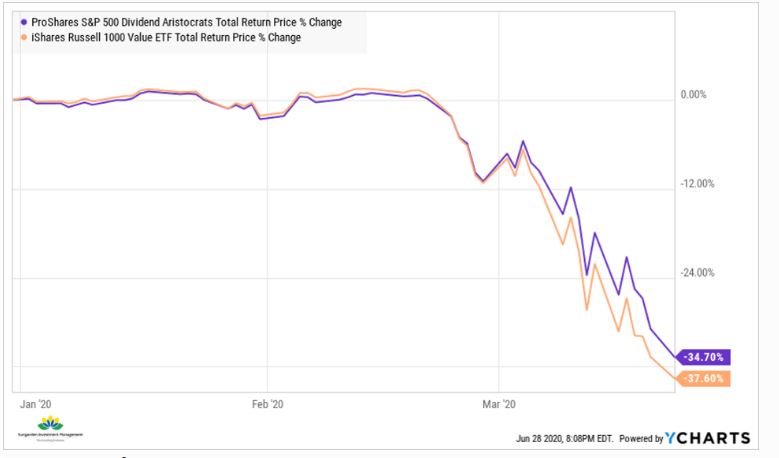

Below is a chart of a “Dividend Aristocrats” ETF that makes this point. Dividend aristocrats are companies that have raised their dividends every year for decades. But even this environment is testing their mettle, with many companies forced to suspend their dividends due to the pandemic’s impact on their earnings.

An aristocrat, a leader, a member of high society in the markets, would probably hold up better than the dividend aristocrats did when that group of stocks started 2020 down 35%, only slightly ahead of their value-stock peers. Now, I am a big believer that earning dividends from your equity investments is a great idea. But at what cost?

These 2 charts tell me this: the market is priced for perfection, despite a very recent warning that all is not well. When even the aristocrats can get pummeled like that, the message is clear. There will be alternating bouts of short-term profit opportunities. But just as likely, there will be additional, rapid reversals.

All this means is that we should all approach equity investing with a tactical, hedged leaning. To do otherwise would be dangerous to your wealth. Please, don’t confuse this knucklehead with a “normal” stock market environment.