Written by: Marc Odo | Swan Global Investments

How Long-Term Put Options Help Investors Take Advantage of a Bear Market

Unpredictable markets can make growing wealth and avoiding losses difficult. Put options are an effective way to manage and reduce this unpredictability. Even more effective are long-term put options, also known as LEAPS: Long-Term Equity Anticipation Securities.

A long-term equity anticipation security are options with expiration dates longer than 12 months. A LEAPS put option offer risk mitigation for a longer time horizon without capping potential upside.

An investment approach that utilizes a LEAPs put option as a long-term hedge, like the Defined Risk Strategy (DRS), has three distinct benefits for long-term investors.

3 Benefits of LEAPS Put Options

LEAPS for Long-Term Defense

A LEAPS put option is a direct way to mitigate undiversifiable market risk. A LEAPS put option is not designed for correction protection but to hedge against portfolio devastation that bear markets can create.

Because it has a one to two-year expiration, it may provide investors the defense they need before, during, and after a bear market (defined as a decline of 20% or more from market highs). Historically, the impacts of bear markets can last anywhere from 1 to 2 years, so having a defense mechanism that investors can count on throughout the bear market is crucial for keeping them invested.

While no two bear markets are the same, they are always damaging to portfolios and investor psyches. The nature of the bear market, whether structural, cyclical, or event-driven, has historically made a difference in the speed, magnitude, and duration of the market selloff and recovery.

In contrast, short-term put options (less than a year for expiration) to hedge a portfolio may leave investors unhedged when they need it most. As a bear market ravages investors’ portfolios, the short-term put option can expire worthless. Subsequently, if a short-term hedge expires or is exercised during a bear market, it may become too expensive to hedge again with a new put option, and in such cases investors may be left to face the full brunt of further declines without protection.

A long-term put option doesn’t put investors in a scenario where they are forced to rehedge under duress when it may not financially make sense. Instead a long-term hedge provides investors with a reliable way to mitigate losses during lengthier bear market selloffs, therefore helping clients remain calm and avoid emotional reactions.

LEAPS for Offsetting Losses

A LEAPS put option gains value when the underlying equity loses value. The more the market falls below the hedge level (strike price), the more valuable the put option becomes. As the put option gains value, it begins to offset additional losses in the portfolio.

It is important to note, this inverse relationship is not linear. As the market sells off, the value of the hedge intensifies, or accelerates; what may start off as a partial offset of losses becomes a dollar-for-dollar offset, and, eventually, the hedge increases more in value than the market declines.

At this point, selling the valuable put option makes sense. It results in a profit that can be used to

- - buy another put option (rehedge),

- - and buy additional shares of the underlying equity.

LEAPS for Acquiring More Equity

LEAPS offer the opportunity for investors to “buy low, sell high.” A huge benefit to selling a valuable put option during a market sell-off is creating the cash necessary to take advantage of a bear market: buying additional equity at a significantly reduced price.

Investors often don’t have the financial or emotional wherewithal to buy when the markets are in a nosedive.

Rehedging with a LEAPS put option provides this opportunity. Selling a valuable hedge during a major selloff creates the investable capital when the investor doesn’t usually have the cash or emotional discipline to buy low.

The additional benefit to this, is the springboard effect for investors’ portfolios when recovery does come. Purchasing additional shares in a market selloff can better position investors for better rebound and faster recovery when the markets turn.

How the DRS Unlocks the Power of LEAPS

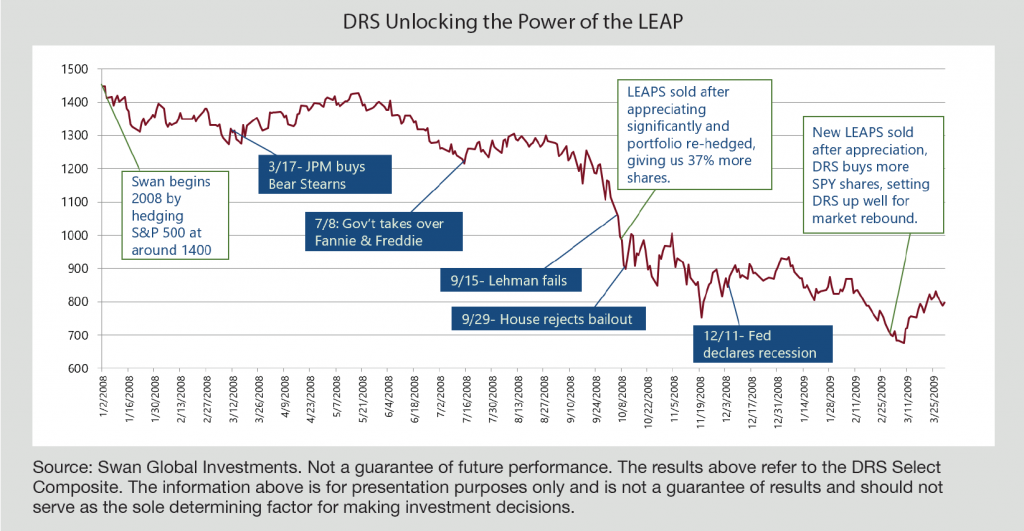

The Swan Defined Risk Strategy Select Composite, launched in 1997, was able to unlock the benefits of the LEAPS put option during the Global Financial Crisis. This bear market provided an opportunity to rehedge twice and serves as an example of the tremendous benefits of the LEAP.

Below is a chart of 2008 and the trajectory of the crisis alongside the treatment of the LEAP.

January 2008: Place Initial Hedge.

We hedged the S&P 500 around 1400 at the beginning of 2008. As the year went on and the market went down, our LEAPS put option continued to gain in value.

September 2008: Sold the LEAP & Purchased More Shares

In between September 15 when Lehman fails and September 29 when the house rejects a bailout, we sold the LEAPS put option, rehedged, and purchased additional shares, resulting in 37% more shares.

February 2009: Sold the 2nd LEAP & Purchased More Shares

In February 2009, we sold the new LEAPS put option, rehedged, and bought more shares.

July 2009 (not pictured): Defined Risk Strategy Completely Recovered from the Selloff.

By unlocking the power of the rehedge twice in the selloff during the Great Financial Crisis, the DRS had recovered from the selloff, while the S&P 500 took about 4.5 years to recover.

In market environments when most investors are sitting on the sidelines or passively experiencing their accounts drop, Swan was able to take advantage of the significantly low prices and set ourselves up pretty well for market rebound.

Long-Term vs Short-Term Hedging

Our LEAPS put option allowed us to get the most value out of our put option.

A short-term put option, like a quarterly put option, may expire during a bear market thus leaving investors unhedged; be cost prohibitive to rehedge during the crisis; require shorter adjustment periods, which means more timing risk; and can be harder to monetize the hedge and buy more when the market sells off.

A long-term put option can have a longer duration than bear markets thus keeping investors always hedged; doesn’t put investors under duress to rehedge during a crisis; requires less frequent adjustments, which means less timing risk; and provides an opportunity to acquire more equity during major market selloffs.

For long-term investors who are worried about a bear market threatening their irreplaceable wealth, a long-term hedge with LEAPS may be the best option.

Hedging for the Long-Term with the Defined Risk Strategy

Avoiding large losses and acquiring more equity during protracted selloffs can better position your clients when the market rebounds. This may reduce recovery time and increase long-term return potential.

A long-term hedge with a LEAPS put option seeks to:

- - Help your clients remain always invested

- - Directly mitigate systematic risk

- - Provide an opportunity to acquire more shares during major market selloffs

Incorporating an investment approach, like the Defined Risk Strategy that utilizes long-term put options for its hedge may provide the long-term defense investors need to reach their goals.

Related: Global Financial Markets to Use China’s Recovery as a Critical Gauge