Written by: David Lebovitz and Nimish Vyas

Many investors came into 2023 with a view that economic growth would slow, profit margins would decline and corporate profits would come under pressure. Well, it turns out that these investors were wrong, as the economy has been growing above trend, profit margins have expanded, earnings growth is positive and the S&P 500 is up nearly 20% year-to-date.

As the risk of slower growth and a potential downturn is pushed into 2024, many are looking to financial conditions for an indication of whether this will materialize. Luckily, the Federal Reserve’s new measure of financial conditions, unlike other measures, provides a direct link to growth. Specifically, it provides an estimate of how financial conditions will contribute to (or detract from) GDP growth over the coming year based on the following variables:

- Federal funds rate

- 10-year U.S. Treasury

- 30-year fixed mortgage rate

- BBB corporate bond yield

- Dow Jones

- Zillow house price index

- Broad dollar nominal index

The weights are derived the from the Fed’s existing U.S. economic model; tighter financial conditions are represented by positive readings in the index and in turn represent negative contributions to GDP growth. Looser financial conditions are represented by negative readings in the index and in turn represent positive contributions to GDP growth.

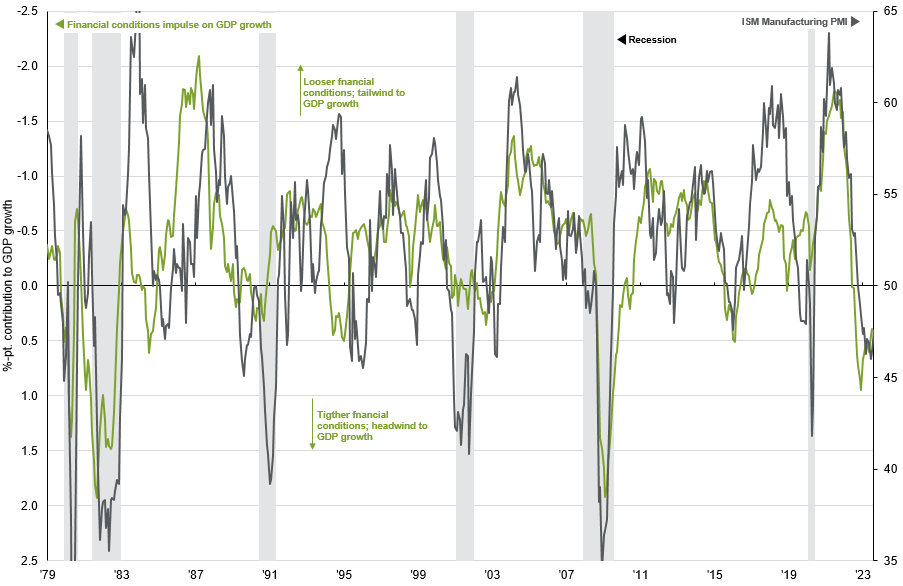

As such, it is reasonable to interpret this index as a leading indicator, and it is no surprise to see that the index is negatively correlated with the manufacturing PMI. Manufacturing PMIs tend to trough during recessions when financial conditions are tightest, and subsequently peak when conditions are loosest. However, over the last 6 months, we have seen the relationship between the two break down – financial conditions have eased but manufacturing PMIs have fallen.

In our view, this divergence has more to do with financial conditions than the manufacturing PMI. Although the Fed has maintained a relatively hawkish rhetoric and not made any clear indication of a change, the market continues to price in a dovish shift in policy, which has kept interest rates and the index muted. BBB corporate bond yields, which have the largest weight in the index, have also been supported by better-than-expected earnings.

Additionally, the index is constructed using a 3-year lookback window, which still includes the very accommodative COVID-19 period. However, as these months roll off and market expectations adjust to price in a Fed that remains higher for longer, financial conditions are likely to tighten. We have already seen some of this begin to materialize, with the U.S. 10-year hitting a multi-year this week. As such, with the possibility of tighter financial conditions going forward, investors may be well served by looking for any signs that these tighter conditions are beginning to weigh on activity.

Economic impact of financial conditions

1979 - present, monthly, Federal Reserve Financial Conditions Index, ISM Manufacturing PMIs

Source:FactSet, Federal Reserve, ISM, J.P. Morgan Asset Managmenet.