Written by: Investment Strategy Team | Wells Fargo

Wells Fargo Investment Institute - March 16, 2020

Key takeaways

The probability of a U.S. economic recession has increased materially, in our view. Whether the U.S. enters its next recession or not will depend upon how long and widespread the coronavirus impact is felt.

The extent of the negative economic and market effects depends much on how federal, state and local governments respond. Particularly worth watching is the federal economic stimulus response, both for its timing, size, and coordination with monetary policy.

What it may mean for investors

Interest rates are likely to stabilize but remain low, in our view, and therefore we prefer to stay close to long-term target allocations in investment-grade fixed income. In other markets, we continue to see opportunities in U.S. equities and in commodities.

1. Has the probability of U.S. recession increased?

Yes, the probability of a recession has increased. It is difficult to pinpoint the exact starting date, but we are watching high-frequency data for signs of a broad decline in spending. Some conditions are still solid, such as mortgage refinancing at a 17-year high, and real-time estimates of first-quarter growth are around 3%. Still, many other conditions are already beginning to erode: freight-car loadings, steady declines in the weekly consumer sentiment indices, and weakening same-store sales. Consumers’ views of the future are deteriorating faster than their views of the current situation, and this difference portends a spending slowdown to follow.

2. The trend lines for the spread of coronavirus in the U.S. appear to mimic Italy—is that where you believe this is headed?

We doubt that the U.S. economy will have to shut down because of a nationwide quarantine. The impact should worsen, both with further infection and as testing reveals more cases. Our expectation, however, is that quarantines will remain primarily a local/regional decision. Also, the U.S. economy is larger geographically than Italy’s and much more dispersed. Moreover, we see a good chance that Congress will take up more substantial measures, such as tax cuts, direct relief to state and local governments, direct financial assistance to victims of the virus, and possibly assistance to industries most adversely affected (health care, manufacturing, and travel, tourism, entertainment–industries that would normally bring together a large number of people).

3. When will we get fiscal stimulus, and what do you believe would make a difference? Which companies may need help, and what help do states and municipalities need? What can be done fast through executive order and what requires Congressional legislation?

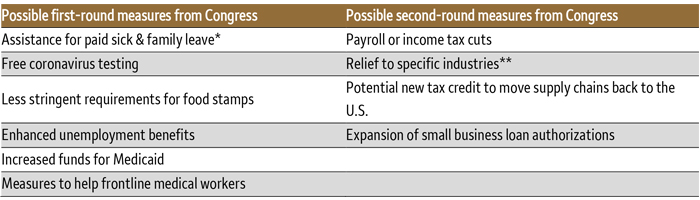

The President declared a state of emergency on Friday (March 13). Certain types of direct lending and possibly extended income tax filing are within the executive remit. The House passed a bill with provisions targeted mainly to help state and local authorities to assist victims of the virus and provide health care. (See Table 1.) The legislation will go to the Senate this week and then quickly to the White House for the President’s signature. A second round of fiscal stimulus may be more along the lines of what investors are looking for – namely, broad support for consumers and businesses affected by the spending slowdown caused by the virus. This second round could be available in the coming 3-4 weeks, depending on how long it takes the two parties to negotiate the deal.

Table 1. Stimulus measures that Congress may consider

Sources: Bloomberg, Wells Fargo Investment Institute, March 13, 2020.

*14 days in the event of a health emergency, offset by tax credits to employers. **Like airlines, hotels, cruise ships.

4. With the World Health Organization’s pandemic call, new travel bans, and major event cancellations, what do you expect for companies and earnings?

We believe earnings will be negatively impacted, but it is too soon to tell how much as the level of uncertainty remains high. With consumers at a standstill, cash flows become even more critical, and companies with high cash balances and low leverage should be best positioned to be able to withstand the turmoil. We could see further slowing in buybacks and business investment spending as cash is redirected toward ongoing operations. We suspect layoffs and further expense cutting would be a last resort if things slow too much. Asset classes best positioned are U.S. Large Cap and Mid-Cap equities and Commodities.

5. In your view, which equity sectors would be most likely to bounce back first in a rebound?

We would continue to focus on higher quality sectors with stronger earnings prospects, those that aren’t as reliant on economic growth. Currently, we favor Information Technology, Communication Services, and Consumer Discretionary. We also like Financials due to cheap valuations, which discount quite a bit of bad news (flat yield curve, low interest rates, slowing economy). We are unfavorable on Energy, Industrials and Materials currently.

6. What is the bond market telling us? Where do you see yields going next?

The bond market was flashing warning signs since last summer when the yield curve inverted. While yields have moved substantially lower in recent weeks, we are starting to see some positive signs in the bond market. Specifically long-term rates are now higher than short term rates across much of the yield curve. It is very typical for the yield curve to continue to steepen over time as the bond market anticipates an eventual recovery. We expect rates to stay relatively low in a historical context going forward, but we do expect falling short-term rates and slightly higher long-term rates in the future.

7. What impact do you believe the Federal Reserve (Fed) rate cut and quantitative easing move, announced Sunday, will have?

The Federal Open Market Committee (FOMC) announced on Sunday that it will cut the federal funds rate by 100 basis points (1.00%) to 0.00%–0.25%. The Fed also announced that it will increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion. The Fed is also coordinating additional liquidity actions with other global central banks.

These actions by the Fed are significant and should support financial market liquidity. By taking these actions, the Fed now has fewer tools to further respond to financial stress in the future, if needed. While these actions are necessary to help financial market liquidity, we believe that additional fiscal actions would be most beneficial to help support the economy going forward.

8. What impact will the actions of Saudi Arabia and Russia have on U.S. oil and the Energy sector?

Saudi Arabia and Russia are the second and third largest petroleum producers in the world. On March 7, Saudi Arabia took the world by surprise by saying it would no longer continue to cut crude oil production, something it had been doing since 2018. The next day of trading, Brent oil, a global crude oil benchmark price, fell from $45 per barrel to $32 (at one point trading in the high $20s). The Saudi statement was in large part a reaction to Russia, which Saudi Arabia felt was not doing its part to curb its own crude oil production.

Thirty-dollar oil does not work for most global oil producers, the Saudis included. For the three largest crude oil producing countries, the U.S., Russia, and Saudi Arabia, $45 is needed, at a minimum, to avoid significant supply dislocations. In the U.S., the average break-even price for shale oil is $45. In Russia, oil revenues are needed to balance government budgets, and research shows $40+ oil is required to do this. Saudi Arabia has one of the lowest break-even costs of any oil producing country, and has little government debt, so many believe it can survive a price war best. We’re not as convinced, as Saudi Arabia’s population is very young (50% of the population is under the age of 30) and its unemployment rate is high, which has led to massive social spending. To balance its budget, the Saudis need something closer to $80 oil prices.

We suspect that Saudi Arabia, Russia, and the rest of the Organization for Petroleum Exporting Countries (OPEC) will come back to the crude oil production-cut bargaining table soon. We doubt that any involved thought $30 oil would happen, let alone be sustained. With global growth in serious question, as the world reacts to coronavirus fears, we believe OPEC plus Russia have a need, and a good excuse, to play nicely and resume production cuts. As for the U.S., we suspect that shale oil production will slow dramatically over the coming months. While clearly bad for U.S. oil producers, it will eventually be good news for global oil prices. As long as oil prices remain suppressed, though, we will likely keep our Most Unfavorable rating on the U.S. Energy sector, and neutral rating on midstream assets (master limited partnerships and C-corps). Our year-end 2020 West Texas Intermediate and Brent oil targets remain $45 and $50 per barrel, respectively.

9. What about gold? What are commodity prices telling us?

Gold is one of our favored commodities for 2020. Once the market volatility dust settles, we believe that investors will once again be bidding-up gold, as they did in January and February, the main driver being low and negative global interest rates. Gold, we believe, will be seen as a good alternative to bonds especially.

Commodity prices began 2020 by falling (except gold), which was a leading sign that not all was copacetic with global growth. This was especially the signal given by key economically sensitive commodities, such as copper and oil. Oil has since been hit by a turf war that has ensued between Saudi Arabia and Russia, which has had little to do with global growth concerns. Copper is the key economically sensitive commodity to watch now, and copper prices have held-up remarkably well in March. We suspect that copper is telling us that global growth is slowing, and odds of a recession have risen, but not odds of a deep recession.

10. What has been the performance of diversified asset allocation portfolio models in the market rout?

As equity markets plunged in the first quarter of 2020, the potential benefits of investing in a diversified mix of assets has been on full display. Global equities are down greater than 23% in the first quarter of 2020, with the Russell 2000, the Russell Midcap, and the MSCI EAFE indices falling the most. Bond returns have offset some of the losses in the equity market, with the Bloomberg Barclays U.S. Aggregate Bond Index up 3% and the Bloomberg Barclays U.S. Treasury Total Return Index up nearly 7%. Even with the weakness in the credit markets, high yield bonds generally have outperformed equities this year, falling around 9%.

It’s also important to keep in mind that historically a diversified portfolio has recovered more quickly than an all-equity portfolio post bear market troughs.1

Download a PDF version of the report

1For a complete demonstration, please see our report, The Value of Diversification: Why should investors consider broad global diversification today?, Wells Fargo Investment Institute, October 11, 2018.