Written by: Samantha Azzarello

While fundamentals– valuations, earnings and economic growth – dominate in the long run, the short run is a different matter. The swift equity market recovery, since the March lows, has taken many investors off their guard. Keeping a pulse on the market mood is an elusive but important part of understanding if we are in risk-on or risk-off mode.

Typically, the AAII Bull/Bear survey is a go-to indicator of sentiment. This indicator tracks the views of investors with a simple yet powerful question: Do you feel the direction of the stock market over the next 6 months will be up, no change or down? Currently, that indicator is more bearish than historical averages. That said, with the number of bearish investors outnumbering those who are bullish, we have seen improvement from a bull minus bear spread of -21.6% the week of March 12th to -4.3% this week.

Interestingly, the notable amount of bears are in stark contrast with sentiment signals coming from retail investors. Multiple reads of retail investor sentiment, including trading volume of single name shares, performance of stock baskets known to be “retail favorites” and even call option volume geared at high priced technology names, all currently reflect bullish sentiment.

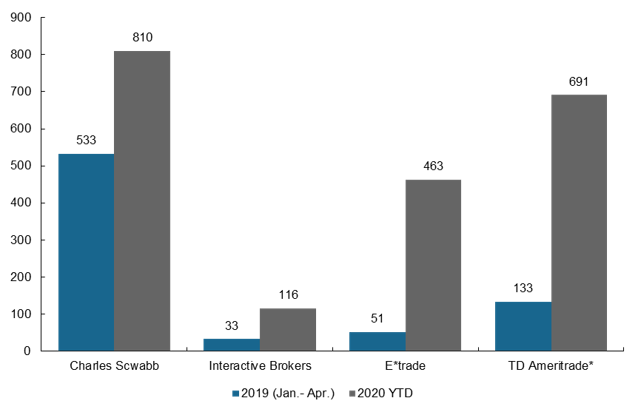

Notably, new account openings by retail investors have skyrocketed across brokerage platforms from this same time last year, as shown in the chart below. While not a traditional sentiment indicator, it does imply that many new investors are looking to take advantage of the equity market recovery.

While momentum, large amounts of liquidity from the U.S. Federal Reserve and better than expected data have all played a part in the equity market rebound, market sentiment- which is multi-faceted to say the least – has likely also played a role.

Net new retail accounts across major online brokers

Thousands, 2020 YTD vs. 2019

Source: Bloomberg, J.P. Morgan Asset Management. *2019 TD Ameritrade net new accounts are based on the first quarter and do not include April 2019. 2020 YTD figures are as of April 2020. Data are as of June 9, 2020.