Is there such a thing as too much of a good thing? Seeking guidance and suggestions from multiple sources can often lead to a very informed decision, however it can also lead to confusion and even less direction. When working with multiple financial professionals, is less more, or is it best to work with several different professionals? The answer, as with many things in life, it depends on what your goals and objectives are.

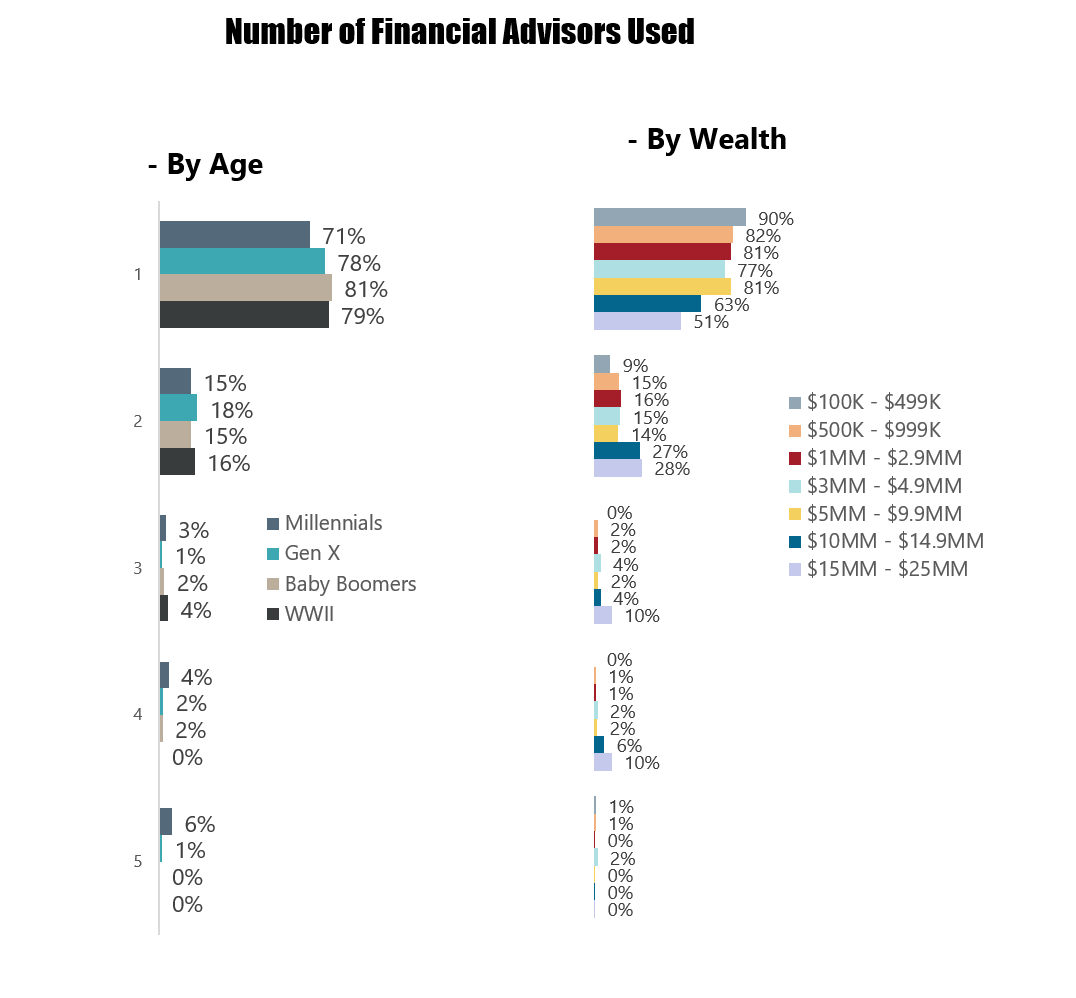

Eighty percent of wealthy investors use only one financial professional, according to the recent report, Advisor Relationships and Loyalty. Millennial investors and investors with the highest wealth levels are the most likely to utilize more than one advisor, in fact, 10 percent of these individuals use 4 or more advisors. Those same individuals have the lowest levels of loyalty towards their financial professionals. They also put more focus on the investment track record of their advisor than other investors.

Being concerned about an investment track record can cause wealthy investors to lose sight of other benefits a financial professional can provide that do not focus on investment returns. Financial professionals can provide significant value outside of investments, such as financial planning, estate planning, non-liquid asset management, and liability management. These types of services do not have a dollar value but they can provide significant benefit to management of an investor’s overall financial picture.

These wealthy investors who are seeking guidance from multiple financial professionals also manage more of their own assets themselves than other investors. Perhaps these individuals are compiling the recommendations from all these sources and utilizing that guidance when investing on their own. Why do these individuals feel they need to seek guidance from multiple sources?

Among those investors who feel they need to seek a new advisor, the majority of them simply do so because they don’t want all of their assets with just one advisor, with over a third of investors feeling they need specialized products or services and they need to seek a financial professional that offers that because their primary advisor does not.

What about when the guidance from the various financial professionals conflict with one another? For those wealthy investors who are not knowledgeable, being able to understand what guidance to follow and what guidance to ignore. That may perhaps be why those investors who are less knowledgeable are more likely to only use one advisor.

Whether a wealthy investor decides to work with 1, 2 or 5 different financial professionals, it is critical to ensure they all are aware of what one another is doing to minimize duplication or over-exposure within the asset allocation. Making the decision to work with another financial provider is one that should be considered and weighed carefully before taking action.