Almost everyone has been impacted financially by the coronavirus and its effects on the American economy.

People have lost jobs, people have had jobs altered, and many people have seen the value of their investments negatively impacted. Retirement accounts, which often hinge on the performance of stock mutual funds for income, were a most visible victim of the economic downturn caused by the virus.

How has the coronavirus and its corresponding impact on the economy affected retired investors?

Spectrem asked that question among others in its three-month study of the financial impact of the coronavirus. Corona Crash: What Advisors Should Be Saying To Investors Now looked at how investors have been affected by the economic impact of the coronavirus, and how current conditions affect their expectations for the future of their financial situation.

For years, Spectrem has asked investors to explain whether their current financial situation is better than it was one year before, as well as whether their financial situation will be better one year from its current situation. Through the years following the Great Recession, the answers have continually improved. This year has been better than last year, and next year will be better than this year, a majority of investors agree.

That was still the case in February, just as the nation began to understand the harm the coronavirus could cause, both to health and to wealth. At that time, 66 percent of investors said their financial situation was better today than it was one year ago. That percentage dropped to 60 percent in March, plummeted to 31 percent in April, then rose slightly to 33 percent in May.

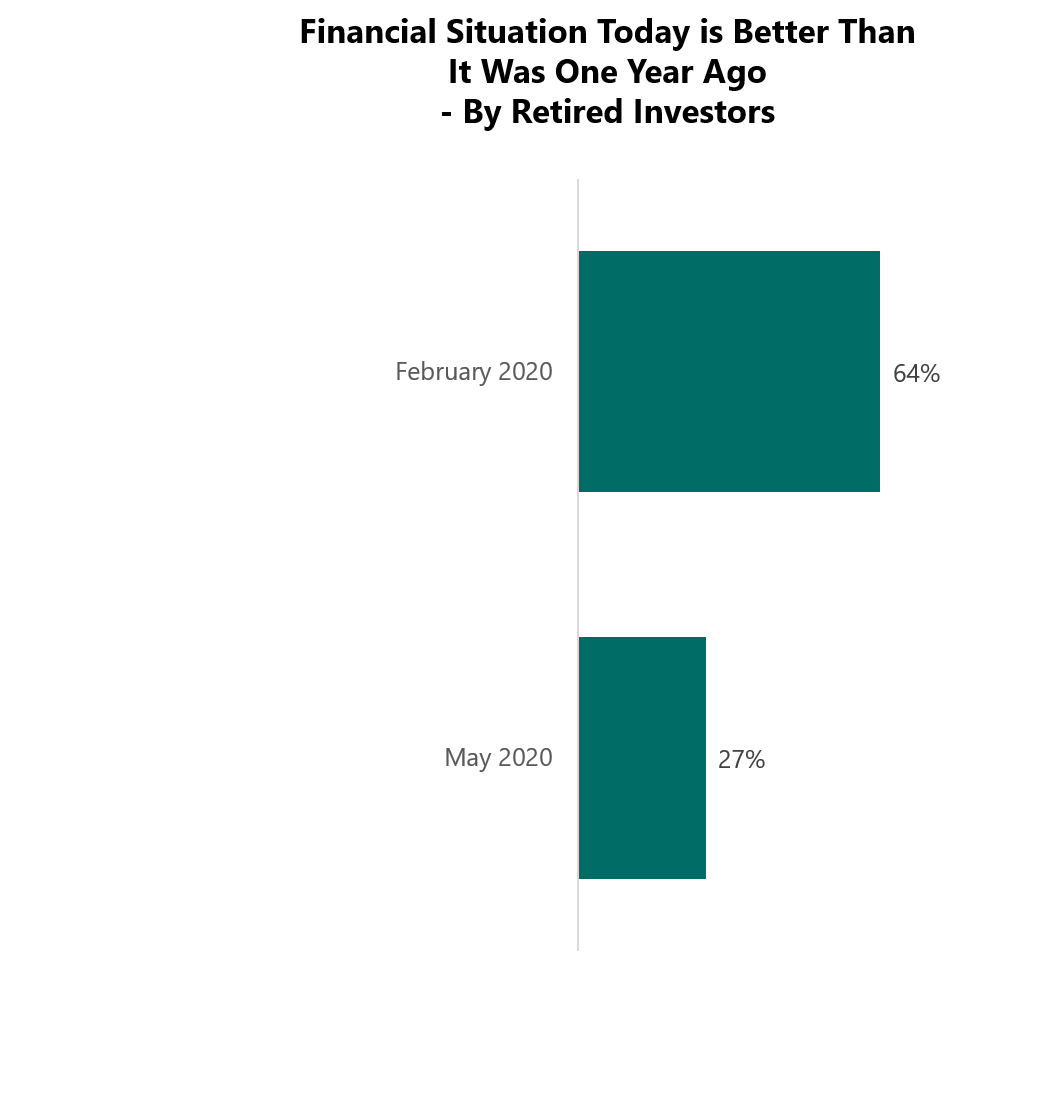

However, among retired investors, the responses were much different from February to May, indicating that the personal economic impact of the coronavirus has hit retired investors harder than it has those who are working.

In February, 64 percent of retired investors said their financial situation was better in 2020 than it was in 2019. The effects of the year-long stock market bull run were still being felt, despite the fact that the stock market was very turbulent throughout 2019.

But in May, after four months of seeing the many ways the coronavirus response caused economic turmoil, only 28 percent of retired investors felt they were better off now than they were at the same time in 2019. That’s more than 30 percent of retired investors whose minds were changed about the manner in which their financial situation had improved in the previous 12 months.

That information is key to the client-advisor relationship among retired investors. Those clients have been hurt financially by what has happened in the stock market and the economy as a result of the coronavirus, and they are not in a position to repair that damage easily without the income that comes from having a full-time job. Retired investors need to hear frequently from their advisor to determine how they are going to respond to the drop in optimism about the current state of their personal finances.

It is interesting to note that, among retired investors, those who think their personal financial situation will be better one year from now has not changed from February to May. Forty-two percent of retired investors agree that their financial situation will be better at this time in 2021. What’s interesting about that is that those investor probably have different reasons to think they are going to be better off in 12 months than they did in February, when they did not know the stock market was going to be crushed the way it was.

Today, retired investors may be thinking that economic fortunes MUST get better in the next 12 months as federal economic experts make decisions to improve the lot of the economy and the stock market.

But those investors probably need to be reassured that their optimism about the future is not misplaced. As with most difficult topics, conversation does improve outlook, and a conversation with your clients is only likely to create a more positive attitude toward your client’s finances as well as your relationship.