For more than a decade, Spectrem Group has been the most reliable source for sizing the number of Millionaires and wealthy households in the United States. This model is based on a an algorithm created over many years between our monthly research with wealthy households and key economic factors. Just like everything else, 2020 has been an aberration in sizing the number of wealthy households.

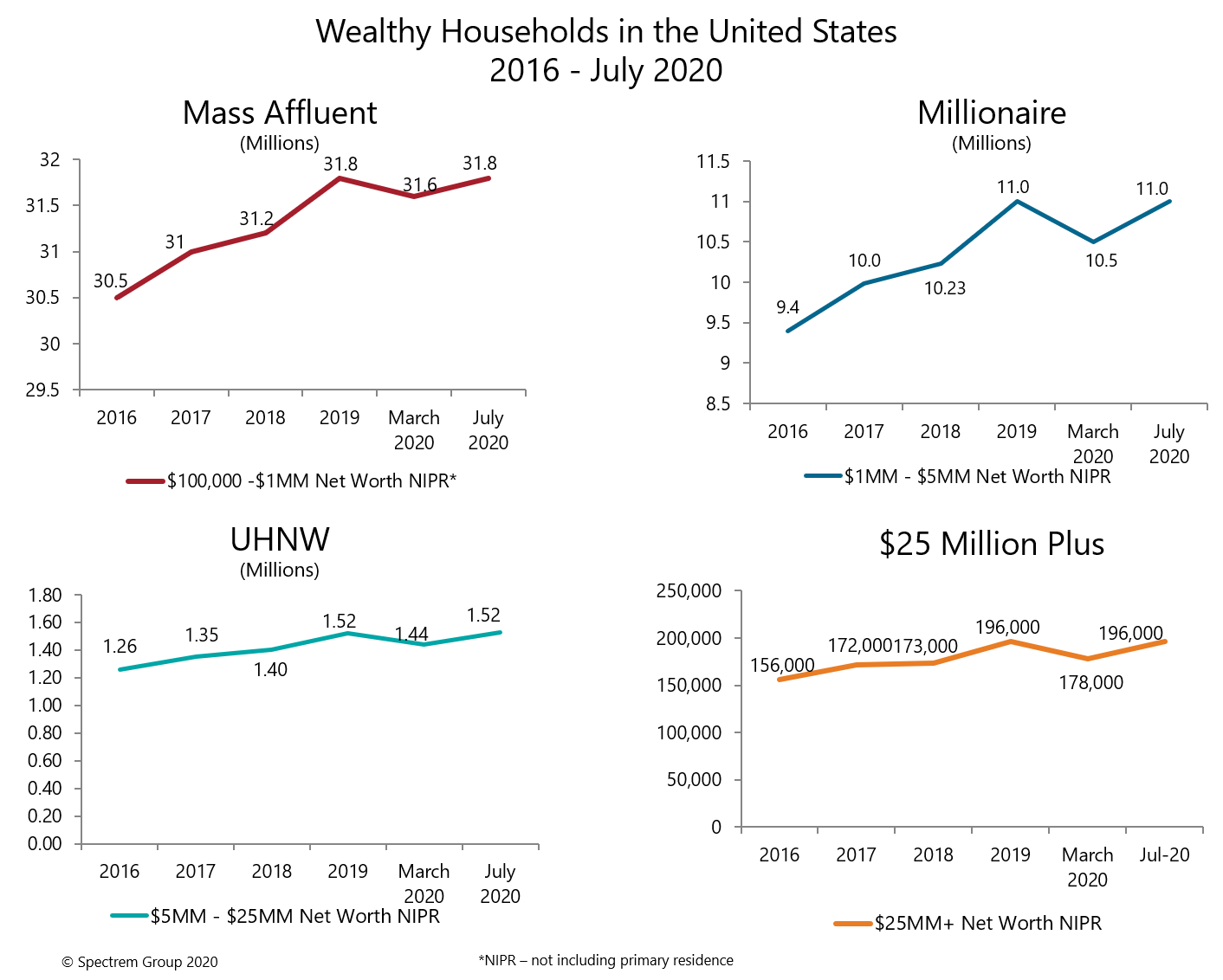

In March 2020 Spectrem decided to re-size the Millionaire market because of the impact of the market crash. As of the end of 2019 there were approximately 11 million Millionaires in the U.S. (Millionaires are defined as those with $1-5 million net worth, not including their primary residence). As of March 2020, that number had declined to approximately 10.5 million. As you can see below, basically all of the segments of the wealth market from Mass Affluent (those with $100,000 to $999,999 net worth not including their primary residence) to Millionaires to UHNW (those with $5 million to $25 million net worth not including primary residence) and $25 Million Plus (those with more than $25 million net worth not including their primary residence) households returned to their prior status as of July 2020. For more information regarding this research and more please see Spectrem Group’s 2020 Market Insights Report by clicking here.

When investors were asked in July whether they felt their financial situation would be better a year from now, 42% said they agreed while 40% neither agreed or disagreed. Only 19% felt their financial situation would be worse a year from now. Wealthier investors were more likely to indicate they felt their financial situation would be better in a year with 59% indicating they felt positively. Who was the least likely to be optimistic about the next year? Those with $1-2 million of net worth.

It’s also interesting to note that optimism is based upon occupation. Those in the Information Technology business are the most likely to feel optimistic about their futures at (48%) while only 25% of Business Owners believe their financial situation will be better in a year. Other occupations fall in between.

While economists and investment advisors are still trying to determine what type of financial recover they United States will experience, investors are somewhat optimistic regarding the future and because of the robust market, many have recovered losses sustained in the spring of 2020.