Tomorrow marks the start of China’s Lunar New Year, meaning it’s out with the Rabbit and in with the Dragon… but all eyes remain on the Bear. And no, I’m not talking about the hit Hulu series, but Russia.

In case you’re not aware, former Fox News host Tucker Carlson posted his interview with Russian President Vladmir Putin on X today. Despite it being over two hours long, I urge everyone to go watch it, not because I place any value in what Putin has to say but to look into the mind of one of America’s and the Western world’s chief adversaries.

When Carlson asks Putin why he invaded Ukraine, Putin launches into a half-hour-long history lesson that begins in the ninth century. Although the president’s command of 1,200 years of Eastern Europe history is impressive, it’s not a serious answer as to why an invasion had to occur in the year 2022.

Carlson is right to ask if all countries should go back to their centuries-old borders, to which Putin says they’re welcome to try.

Ukraine declared its independence in 1991 after the fall of the Soviet Union, along with Lithuania, Belarus, Crotia, Slovenia and other former Soviet states. It would be difficult to make the argument that Ukraine is a model country—as the poorest nation in Europe, it still struggles with corruption—but after more than 30 years of self-rule, it’s just as entitled to defend itself from violent aggressors as Israel is.

That’s true no matter a person’s opinions on Putin, Carlson, Ukrainian President Volodymyr Zelenskyy or President Joe Biden.

From Boom To Bust

A little over a year ago, the world watched as China reopened its doors after three long years of strict pandemic lockdowns. Expectations were high for a robust economic recovery, fueled by pent-up demand and consumer spending.

The reality has been starkly different. Despite a bustling travel season around China’s Lunar New Year—with a record 9 billion domestic trips expected, 80 million by air—the anticipated economic rebound has largely failed to materialize, even as world markets have surged to record to near-record highs.

This downturn appears not to be just a temporary blip, but a sign of deeper structural issues within the Chinese economy. The nation’s gross domestic product (GDP) reportedly grew 5.2% in 2023, an admirable print at first glance, but it masks underlying challenges. A closer look reveals a significant slowdown from the pre-pandemic era of consistent +6% growth. Select industries such as electric vehicles (EVs) saw remarkable sales in China last year, but this strength hasn’t been enough to offset serious weaknesses in other sectors, particularly real estate, which remains a major drag on the economy.

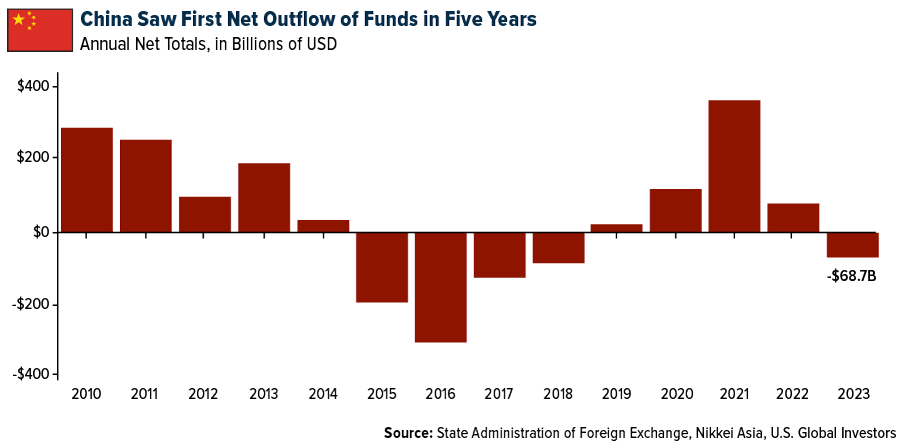

Our decision to close the China Region Fund last year was a move predicated on recognizing early signs of these economic challenges. It’s a decision that, in hindsight, has been vindicated. The ongoing property sector slump and regulatory uncertainties have further exacerbated investor apprehension, leading to a significant outflow of $68.7 billion in foreign direct investment (FDI) for the first time since 2018.

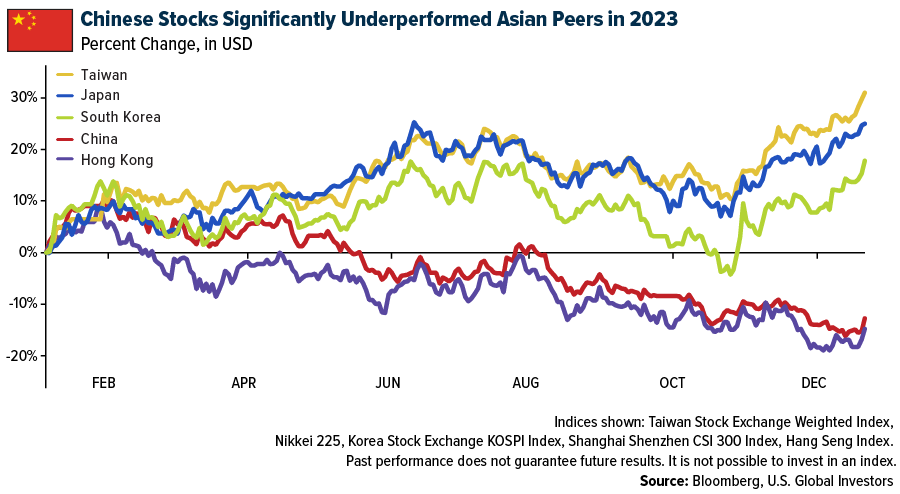

Chinese equities continue to underperform. Both mainland stocks and those listed in Hong Kong ended 2023 with losses, even as other Asia-Pacific markets rallied. Remarkably, Japan’s Nikkei 225 is poised to hit a new all-time high after 34 years.

This year isn’t off to a great start for Chinese stocks, either. The CSI 300 shed over 7% in January, while the Hang Seng lost over 9%.

“China seems to be divorced from the rest of the world,” Steve Sosnick, chief strategist at Interactive Brokers, told Bloomberg. “Part of the lack of equity response is that the global economy is doing OK without China.”

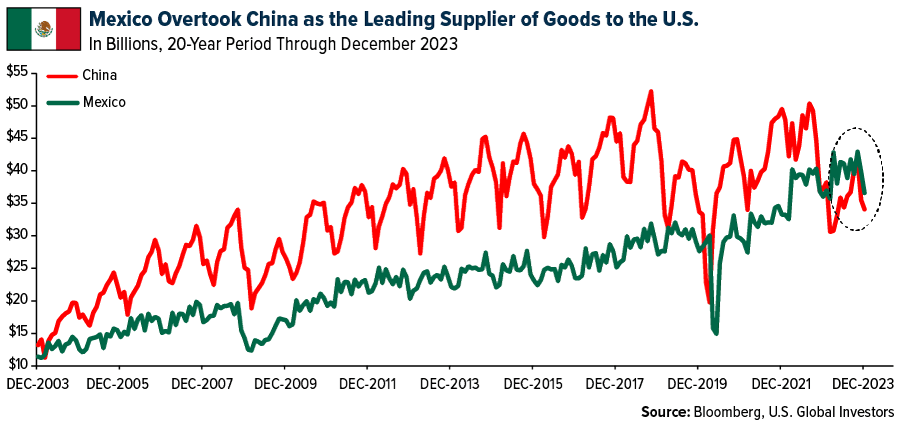

Mexico Surpasses China As America’s Top Import Source

Indeed, in a shift not seen in over 20 years, Mexico outpaced China last year to become the top supplier of imports to the U.S. This change highlights the escalating strains between Washington and Beijing, alongside American initiatives to source more goods from closer, more allied nations.

Recent data from the Commerce Department indicates that imports from Mexico to the U.S. increased nearly 5% from 2022 to 2023, reaching over $475 billion. Conversely, the import value from China saw a sharp decline of 20%, falling to $427 billion.

Will China’s Steps To Stabilize The Market Work?

Efforts to stabilize the Chinese market have so far failed to lift investor confidence. On Tuesday, the China Securities Regulatory Commission (CSRC) announced plans to halt the practice of brokerages borrowing shares to lend them out and to limit the scope of what’s referred to as the securities re-lending market, in a move aimed at reining in short-selling activities.

This came a day after the regulator vowed “zero tolerance” against short sellers, warning them they could “lose their shirts and rot in jail,” according to reporting by Reuters.

These regulatory steps were introduced after the Chinese government declared in October 2023 that it would issue 1 trillion yuan ($140 billion) in Chinese Government Bonds (CGB) to support local government finances and fund infrastructure projects in areas affected by natural disasters over the past year.

The move was meant to send a signal to global markets that China is “pro-growth” again, but as Morgan Stanley’s Schuyler Hooper writes, the strategy is seen as “merely a repeat of China’s old policy playbook, where they rely on investment to prop up ‘economic’ growth, while growth in consumption, export, property and private investment remains sluggish.”

The risk, Hooper points out, “is a short-lived cyclical rebound amid a longer-term secular slowdown” in the Chinese market.

The Critical Role Of Diversification

The Chinese government faces a daunting task in addressing the deep-seated issues within its economy. Chaos in the real estate market, local government debt and deflationary pressures are significant hurdles to sustained growth. Geopolitical tensions add another layer of complexity.

The situation serves as a reminder of the importance of diversification and the need to remain agile. I believe it’s more important than ever to rely on sound investment principles and a diversified portfolio.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.04%. The S&P 500 Stock Index rose 1.35%, while the Nasdaq Composite climbed 2.31%. The Russell 2000 small capitalization index rose 2.40% this week.

- The Hang Seng Composite gained 1.57% this week; while Taiwan was up 0.20% and the KOSPI rose 0.18%.

- The 10-year Treasury bond yield rose 15 basis points to 4.172%.

Airlines And Shipping

Strengths

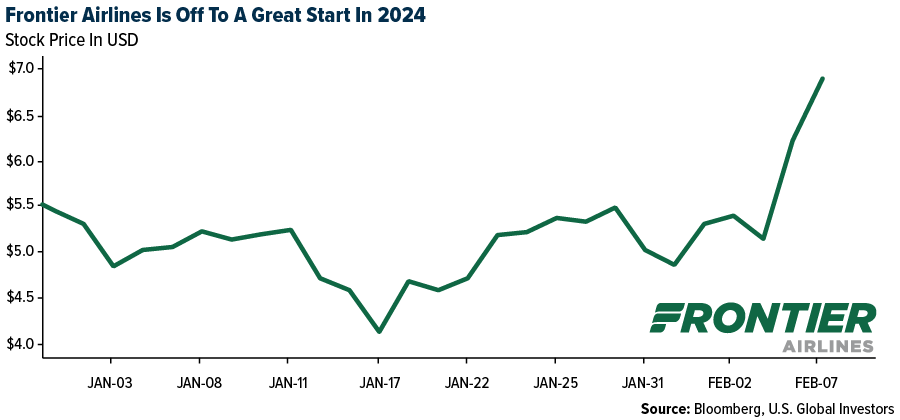

- The best performing airline stock for the week was Frontier, up 39.9%. Allegiant’s fourth quarter 2023 earnings per share (EPS) was $0.11, compared to consensus’ $(0.23) estimates, largely on lower drag from Sunseeker versus consensus. The airline segment’s fourth quarter EBIT of $20.6 million was slightly ahead of the $19.1 million consensus.

- According to Morgan Stanley, the world’s 13 largest container shipping lines significantly improved their schedule reliability in 2023. On-time performance increased from 42.6% to 62.1% in 2023, an improvement of 19.5 percentage points, according to Sea-Intelligence’s Global Liner Performance report, which measures the ability to arrive on time for the world’s 13 largest container carriers.

- Frontier Airlines’ fourth quarter EPS of $(0.17) compares to consensus of $(0.24), with the beat versus consensus driven by better costs and slightly stronger revenue. Aircraft utilization was 11.3 hours in the quarter, consistent with the third quarter of last year, but down slightly from 11.5 in the same quarter of 2022.

Weaknesses

- The worst performing airline stock for the week was Azul, down 10.8%. According to Bank of America, airline stocks declined 1% in January compared to the S&P 500’s positive 2% jump after meaningfully underperforming the market in 2023. First quarter 2024 revenue outlooks have generally met or exceeded their expectations, while valuation multiples have moved lower in January on other industry risks and events.

- Maersk issued a fiscal year 2024 (FY24) outlook that was below market expectations and suspended its buyback program. The company guided to FY24 $1 billion to $6 billion EBITDA and -$5 to $0bn EBIT, noting that the high and low ends of the ranges assume that Red Sea disruptions are resolved in the first quarter of this year or last the whole of FY24, respectively.

- According to JP Morgan, Chinese airlines’ fourth quarter results came in below expectations as Big Three net loss of Rmb4B was wider than prior fourth quarters seen before the pandemic (2016-2019). The market has very likely priced in the anticipated weakness caused by the off-peak, post-holiday period in the fourth quarter of 2023.

Opportunities

- ISI tracks web traffic to airline websites as a proxy for bookings. Airline web traffic was up 3% year-over-year for the week, compared to up 4% year-over-year in the trailing four-week period.

- According to Morgan Stanley, ZTO experienced a significant de-rating with consensus 2023 and 2024 earnings having downward adjustments by 1% and 5% from their respective peaks in the past six months. ZTO is trading at a 30-40% discount to global peers. The group sees a potential inflection point that ZTO’s earnings growth can return to double digits in the first quarter of 2024 in a bull case or in the fourth quarter of this year in a bear case and trigger a re-rating.

- According to Bank of America, Frontier raised capacity by 440/830 basis points (bps) in April and May, and nearly 11% in June and July. While the April and May additions benefitted domestic flying, June and July’s increases were seen in both domestic and Latin American networks. Despite the significant additions leading into the summer travel season, Frontier’s second quarter 2024 capacity is currently tracking up 3.0% year-over-year, well below consensus of up 12%.

Threats

- Verdi called for a one-day warning strike for Lufthansa’s ground crew in Frankfurt, Munich, Hamburg, Berlin, and Dusseldorf, according to a statement. They call the offer presented for 25,000 employees in negotiations so far, “completely inadequate.” They say key sticking points include eight months without pay progression at the start, low increments, and a 36-month term.

- JPMorgan says there is a rising likelihood that no quick fix exists for the ongoing Red Sea crisis, with disruption caused by Houthis likely to continue in the coming months or even years. The bank notes the disruptive impact is more extensive for container freight markets and consumer prices versus oil and energy markets, given the containerships’ heavier dependence on the Red Sea and oil trade’s fungibility.

- According to Morgan Stanley, Boeing announced that 50 undelivered 737 MAX airplanes will have to be reworked due to its supplier, Spirit AeroSystems, finding two mis-drilled holes during a safety check, reports Reuters. Boeing confirmed to Reuters that the mis-drilled holes are not of concern to existing 737 aircraft and that they can continue to fly according to schedule.

Luxury Goods And International Markets

Strengths

- Shares of Kering trading in France gained more than 5% on Thursday after the company reported better-than-expected performance from Gucci, with sales above estimates. Chief Executive Officer François-Henri Pinault is focused on fixing Gucci, where the company generates about two-thirds of the group’s profits.

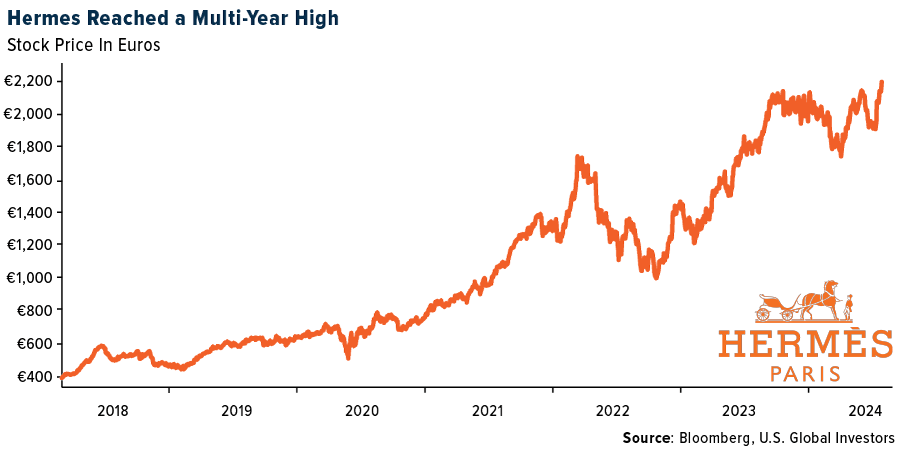

- Shares of Hermès reached a record high this week. The company reported strong quarterly results on February 9 and also posted a record annual net profit of 4.3 billion euros. Morgan Stanley upgraded its recommendation on the company to overweight, citing the sales of Birkin and Kelly handbags driving the company’s sales. Hermès’ focus on the wealthiest clients has protected it from the broader sector’s downturn, as the super-rich continue to spend despite rising yields and inflation.

- Ralph Lauren was the best performing S&P Global Luxury stock, gaining 18.43% in the past five days. Shares gained more than 16% in a single day of trading on Thursday, after the company reported an earnings beat.

Weaknesses

- China continues to report weak economic data. January inflation fell by 80 basis points on a year-over-year basis, exceeding the expected negative 50 basis points, and extending the deflationary trend into a fourth month. Food prices fell by a record 5.9% as pork prices declined further. Producer prices fell by 2.5% against expectations of a 2.6% decline.

- L’Oréal reported weaker-than-expected quarterly results, attributing the shortfall to sales in the North Asia region, which were well below forecasts. By company segment, luxury and consumer products drove the sales miss, while the Derma unit posted very strong growth.

- Faraday Future Intelligence was the worst performing S&P Global Luxury stock, losing 24.68% in the past five days. Last year, the market cap of the company declined by 99.9%. Friday’s closing price reached a new low of $0.09.

Opportunities

- Hilton has announced partnerships with small luxury hotels around the world. Customers will soon be able to book and earn points (for those using the Hilton Honors program) for a stay at the additional 560 small luxury hotels across 90 countries. As of December 31, 2023, Hilton had approximately 3,270 hotels representing 462,400 rooms throughout 118 countries and territories.

- Estee Lauder reported better-than-expected results and will focus on restructuring the program costing as much as $700 million, aiming to raise operating profitability by $1-1.4 billion in 2025 and 2026. Part of the plan will require cutting as many as 3,000 jobs to put one of the world’s largest beauty companies back on track.

- China’s consumers are buying more luxury clothes even as the economy struggles, Bloomberg reported this week. Ralph Lauren reported strong sales in the mainland, increasing by 30%, while Coach parent Tapestry saw a surge of 19%. China’s numbers are coming from a low base due to prolonged Covid-19 restrictions and should continue to improve.

Threats

- Europe’s most powerful country, Germany, saw residential property prices drop the most on record in 2023. Multi-family homes were leading the decline at 20%, as per data from the Kiel Institute. Apartments fell by 9%, while single-family homes declined by 7%. German landlord TAG is warning that home prices could fall 30% from the peak.

- The beginning of the Luna New Year travel rush in China started harshly as blizzards and freezing rain brought massive disruptions, leaving passengers stuck in cars on highways and passengers struggling to rebook canceled flights. It was estimated that 9 billion domestic trips would be made during a 40-day travel rush around the Lunar New Year holiday. That would be nearly double the 4.7 billion trips made during the so-called Spring Festival travel rush in 2023 when ultra-strict Covid restrictions were abolished.

- The Chinese government has taken emergency measures to support the plunging stock market, such as targeting short-sellers and freeing up cash for banks. However, these actions have not been sufficient to address the deeper issues at play, Bloomberg reported on Thursday. The Shanghai Shenzhen CSI 300 Index reached a new multi-year low level at the beginning of February.

Energy And Natural Resources

Strengths

- The best performing commodity for the week was WTI crude oil, rising 5.82%, on news that Israel rejected a proposed cease-fire from Hamas, amid escalating tensions over a solution to lower hostilities. Peru’s copper production soared to a record 2.75 million tons, up 13% year-over-year, according to the country’s Ministry of Mining and Energy. The growth can largely be attributed to the ramp-up of Anglo American’s Quellaveco operation, while Las Bambas recorded a substantial 19% year-over-year increase in production, credited to uninterrupted operations.

- Uranium prices were up this past week following Kazatomprom’s operations update cutting 2024 production guidance to 54-58 million pounds, down from 65-66 million pounds previously. Kazatomprom had previously announced 2024 production would be below prior guidance but did not provide specific volume figures until this past week, which was below expectations at 62 million pounds. The company remains committed to contracted deliveries for 2024, noting comfortable inventory levels and availability from uncommitted volumes.

- Canada has leapfrogged China to reign supreme in Bloomberg NEF’s Global Lithium-Ion Supply Chain Ranking. For the first time, China has come in second among the 30 markets assessed on their existing supply chain activities, quality of their industrial landscape and supporting infrastructure and innovation and ESG credentials. The Inflation Reduction Act (IRA) helped the U.S. reinforce its third position. Representing Europe, Germany and Finland round out the top five, joined by an improved South Korea.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 10.97%, and is down 40% over the last three months. Although the U.S. saw a week of bitterly cold temperatures in January, the rest of the winter has been unseasonable warm, and recent forecast suggest that trend should continue. Russia’s seaborne crude shipments rebounded strongly from two weeks of disruptions, with record-equaling flows from the country’s main export terminals. Eleven tankers completed loading of the country’s ESPO crude at the Pacific port of Kozmino, recovering after a storm halved exports the week before and matching previous highs. Volumes from the Baltic port of Ust-Luga also gained in the week, after maintenance work cut flows late last month, while shipments from Primorsk equaled the previous week’s record. The bounce back saw weekly average shipments surge by about 880,000 barrels a day to the highest this year.

- According to RBC, per Benchmark, lithium carbonate and hydroxide prices decreased 10.3%/11.9% in the week, although most lithium chemicals rose marginally as Chinese spot market sentiment improved ahead of the Spring Festival. Prices are now in the $11,000 to $15,000 per ton range depending on the grade while spodumene is $850 per ton. They believe there is price support at current levels given low (one-month) inventories and marginal cost in the $10,000 to $15,000 per ton range for non-integrated and Chinese lepidolite players.

- According to BMO, spot HRC steel prices in the U.S. declined 2.8% over the past two weeks to $1,060 per ton, with the decline primarily attributed to limited spot market activity as buyers remain on the sidelines given market uncertainty. In their view, with lead times continuing to compress, spot availability improving, scrap prices currently are expected to be flat to lower in February, with other raw material prices trending lower, and with inventory levels in the supply chain reportedly rightsized, the spot HRC prices are likely to moderate further, absent a positive demand surprise and/or mills reducing spot supply.

Opportunities

- India will earmark a major share of the $134 billion in planned infrastructure spending in next year’s budget to the energy sector to meet surging demand, according to Prime Minister Narendra Modi. The Indian leader is attempting to persuade voters at upcoming elections that his government can provide cheap and reliable electricity, while simultaneously pursuing policies aimed at accelerating efforts to curb greenhouse gas emissions.

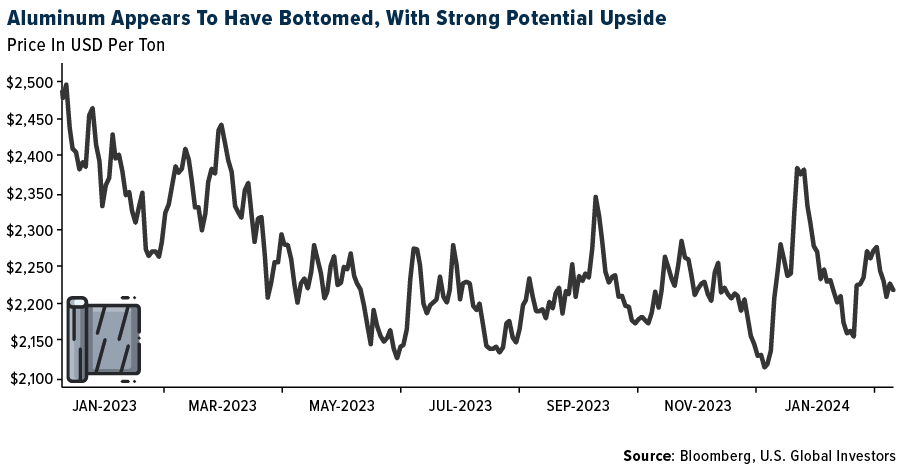

- According to Bank of America, aluminum prices have found support around $2,200 per ton, notwithstanding persistent macro headwinds. That support has been driven by a confluence of factors. Most importantly, perhaps, global aluminum supply is expanding by an average of only 2.4% out to 2025, compared to 4.7% between 2011 and 2017. Tying in demand, they expect consumption growth of 4% per annum until 2030 in their base case, compared to an average of 5% per year in the past decade, implying sustained deficits.

- Ivanhoe Mines, chaired by billionaire Robert Friedland, and commodities trader Trafigura Group signed deals to transport copper by rail from the Democratic Republic of the Congo (DRC) to neighboring Angola’s port of Lobito, marking the first long-term deal for the railway project that the U.S. government is backing. Trafigura is part of the consortium that won a 30-year concession to operate the Lobito railroad that could become a key export route for DRC’s fast-growing production of copper and cobalt — both crucial metals for the energy transition. Ivanhoe says the route could drastically cut transport times and lower emissions.

Threats

- Iron ore hit a three-month low as the upcoming Lunar New Year and ongoing property market crisis cast a shadow over Chinese demand. Benchmark futures in Singapore dropped for the fifth time in six sessions, sinking below $124 a ton to hit the lowest intraday level since early November. Hot-metal production in China is muted, with pre-holiday steel demand generally weak, according to Huatai Futures Co. The nation’s property market — the largest driver of steel demand — continues to face liquidity woes.

- This week, KoBold Metals, a private mining startup that uses artificial intelligence to explore for material key to the green-energy transition, said it discovered a huge copper deposit in Zambia, but it released no data to characterize or quantify the new discovery. Turns out, the unnamed deposit in the press release is the Mingomba copper deposit that was discovered in 1979 by Anglo American, which decided not to exploit the deposit because it was deemed uneconomical at that time. Kobold Metals has now acquired the rights to the undeveloped deposit, but it is disingenuous to imply a new discovery was made with the use of AI as some news headlines wrote.

- According to BMO, a private members bill (C-372) labeled the “Fossil Fuel Advertising Act” was introduced to Canadian parliament this week, aimed at prohibiting advertising and promotion of fossil fuels. According to the document, the main purpose of the legislation is to “prevent the public from being deceived or misled with respect to the environmental and health hazards of using fossil fuels.” Of note from a business operations perspective, the regulation would prevent fuel retailers from offering point of sale promotions including gifts, discounts, or cash rebates on fuel purchases.

Bitcoin And Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Dymension, rising 74.28%.

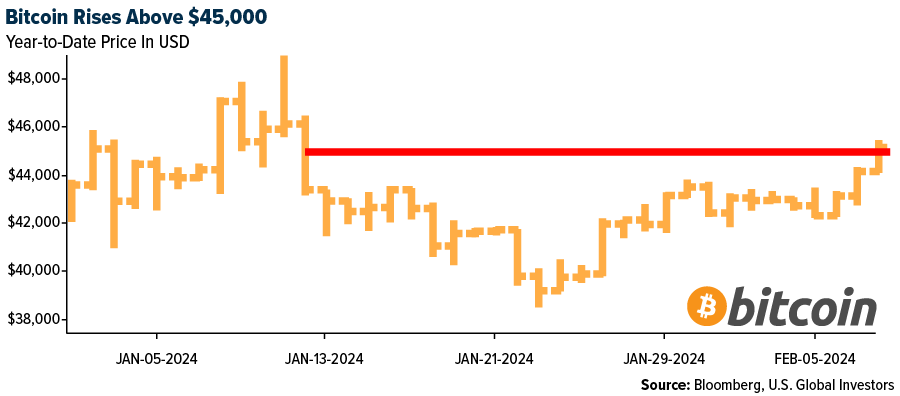

- Bitcoin topped $45,000 for the first time in almost a month with U.S. ETFs holding the digital currency seeing a steady inflow of cash from investors and risk appetite rising across financial markets, writes Bloomberg.

- MicroStrategy returned to profitability in the fourth quarter after registering a tax benefit related to its horde of Bitcoin. Michael Saylor said in a statement that the company posted a net income of $89.1 million compared with a loss of $249.7 million a year earlier, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Monero, down 27.88%.

- Bitcoin miners are getting a jump on an anticipated decline in revenue from the so-called halving in April, when the blockchain’s network protocol will reduce rewards for verifying transactions by half. Miners’ reserves have dropped by 8,400 tokens since the start of 2024 to 1.8 million, according to Bloomberg.

- Genesis Global Holdco LLC sought bankruptcy court permission to sell all of its shares in three digital asset trusts managed by Grayscale Investments LLC worth $1.6 billion, writes Bloomberg.

Opportunities

- Hong Kong’s government launched a public consultation on legislative proposals to introduce a licensing regime for providers of over-the-counter trading services of virtual assets, according to Bloomberg. The consultation will last for two months until April 12.

- Bitcoin advanced beyond $47,000 and reached a one-month high during the week, supported by signs of steady inflows into spot Bitcoin ETFs, as well as growing attention on the so-called halving happening in April, writes Bloomberg.

- Crypto related stocks rallied in U.S. premarket trading on Friday as Bitcoin climbed back toward $46,000. CleanSpark led the gains in premarket trading, rising 18% after its first quarter results showed revenue and adjusted Ebitda beating estimates, writes Bloomberg.

Threats

- The NBA was hit with a lawsuit over its marketing links to failed crypto exchange Voyager Digital Holdings, which investors claim led to $4.2 billion in losses. The NBA was “grossly negligent” in agreeing to a marketing deal with Voyager and Mark Cuban, the former owner of the Dallas Mavericks, the investors alleged in a suit filed Tuesday in Miami, writes Bloomberg.

- The former CEO of a Kansas bank was charged with embezzling $47.1 million from the lender to buy cryptocurrency, as the tale of tiny Heartland Tri-State Bank and its failure unfolds, writes Bloomberg.

- The alleged fraud at Gemini Trust and Barry Silbert’s Digital Currency group was three times bigger than initially thought, the New York attorney general said in a revised civil complaint that now seeks $3 billion in restitution, writes Bloomberg.

Gold Market

This week gold futures closed the week at $2,039.50, down $14.20 per ounce, or 0.69%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 4.12%. The S&P/TSX Venture Index came in off 1.86%. The U.S. Trade-Weighted Dollar rose just 0.14%.

Strengths

- The best performing precious metal for the week was gold, but still down 0.69%. Gold has found friends with central banks around the world. China added nearly 300 tons of the yellow metal in its fifteenth consecutive monthly purchase. Iraq’s central bank increased its gold reserves last month and plans more purchases this year, according to a senior official. The country bought nearly 2.3 tons of bullion at the end of January at an average price of $2,037 per ounce, bringing total holdings to 145 tons, said Mazin Sabah, director general of the central bank’s investments department. Future purchases will take Iraq’s holdings to a record, he said, as reported by Bloomberg.

- Platinum costs more than palladium for the first time in over five years, driven by its growing use in auto catalysts for gasoline-powered cars. Both metals have come under pressure this year as consumers drew down stockpiles built following the invasion of Ukraine, but palladium has suffered the most, sliding almost 20%. Its longstanding premium to platinum has caused automakers to increasingly substitute it for the cheaper metal, as reported by Bloomberg.

- According to UBS, diamond fundamentals are improving after the mid-stream destock in the second half of 2023 and prices are stabilizing following the Indian import freeze in Oct/Nov-23; prices are expected to remain stable during the first half of this year, while rough producers destock and lift in the second half. Jewelry retail sales growth is expected to normalize in the U.S. in 2024 with India to remain strong and China weak.

Weaknesses

- The worst performing precious metal for the week was palladium, down 8.85%, as it now trades just below platinum. Analysts expect the supply of palladium to rise relative to a less certain growth profile for platinum, as reported by Bloomberg. Gold dropped as Federal Reserve Chair Jerome Powell said that investors may have to wait beyond March for the U.S. central bank to cut interest rates, aiding Treasury yields and the dollar. Spot bullion dropped below $2,030 an ounce after CBS aired a 60 Minutes interview with Powell, which was conducted Thursday, in which he again signaled that a move to ease policy in March was unlikely, although reductions later in the year were on track.

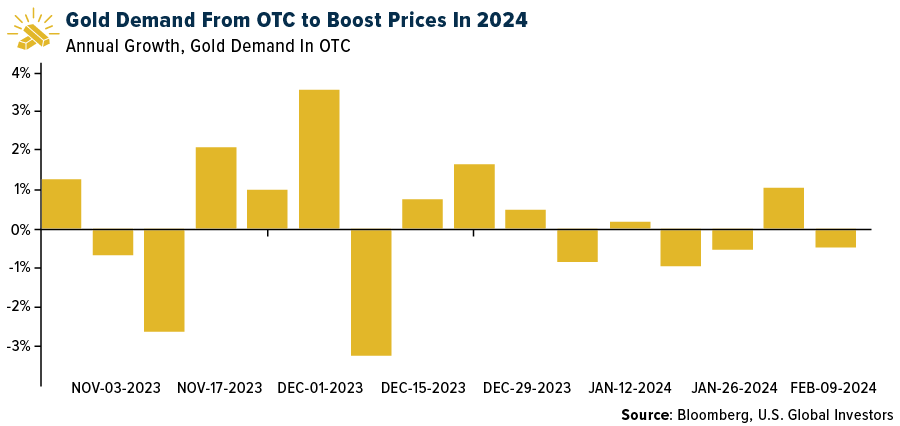

- According to Bank of America, the World Gold Council (WGC) released its fourth quarter 2023 and full-year 2023 Gold Demand Trends report on global gold market demand and supply. Gold consumption demand declined 11%, or 140 tons to 1,190t in Q4. Exchange traded fund (ETF) outflows continued for the seventh quarter in a row with Q4 totaling 56 tons. Retail investment was also down 7% or 23 tons to 582 tons.

- Some Russian banks appear to have maneuvered around a ban on shipping dollars and euros to the country by trading gold in the United Arab Emirates and Turkey, according to research from a financial-intelligence company. The sanctions on the export of banknotes were introduced after the Kremlin’s invasion of Ukraine. The report, compiled by Sayari, found that in the first quarter of 2023, the financial institutions — which include Lanta Bank JSC, whose owners control gold miner GV Gold, and at least one lender that is not sanctioned — imported more than the equivalent of $82 million in euros, dollars, and UAE dirhams. The data shows that several of the same entities used to ship cash to Russia also imported gold from Russia within similar timeframes.

Opportunities

- Kalamazoo Resources says that an option agreement was signed with De Grey Mining to acquire its 1.44Moz Ashburton Gold Project by the payment of an option fee of A$3 million cash. Kalamazoo has granted De Grey exclusivity for 12 months, with the right to extend it for a further six months.

- Scotia anticipates most miners to post slightly stronger fourth quarter 2023 financial results driven by a meaningful improvement in operating performance as commodity price changes were muted. Although guidance risks remain skewed to the downside given the challenging operating environment, most miners have already pre-released 2024 guidance, limiting potential disappointment.

- Red 5 (RED) and Silver Lake Resources (SLR) have agreed to merge via Scheme of Arrangement, subject to SLR shareholder approval. RED will acquire 100% of SLR, with SLR shareholders to receive 3.434 RED shares for every one SLR share. Resultant ownership in the merged entity will be RED shareholders 52% and SLR shareholders 48%. Assuming the merger completes, RED (the surviving entity) would have a market capitalization of $2.2 billion and be a top 5 ASX gold company in terms of production, resources (12.4M ounces) and reserves (4M ounces) and have a net cash position of $235 million.

Threats

- According to UBS, lab-grown diamonds supply for jewelry has doubled every two years since 2015 reaching 20M carats in 2023 (versus natural 120 million carats); the expert expects it to double again over the next two years, value penetration will likely reach 20% of global diamond jewelry demand; of this $10 billion is expected to take sales from natural stones with the remainder creating new sales. Lab-grown diamonds generally carry higher merchandise margins relative to natural diamonds and other precious metals jewelry given a lower production cost.

- De Beers expects any recovery in the beleaguered diamond market to be slow and gradual as the industry continues to suffer from weak economic growth in key markets such as China and the U.S. The sector almost came to a complete standstill in the second half of last year as De Beers and Alrosa PJSC — the two biggest miners — all but stopped supplies in a desperate attempt to stem a slump in prices.

- According to Morgan Stanley, President Andres Manuel Lopez Obrador (AMLO) of Mexico presented Congress with a draft of 20 proposed reforms to the Mexican Constitution. The proposals include two reforms for the mining industry and three for the railway sector. On the mining side, the proposed changes call for the prohibition of concessions i) for open pit mining and ii) in areas that suffer from a scarcity of water.

Related: The Future Is Copper: Insights Into the Metal’s Pivotal Role in Global Growth and Sustainability