Written by: Kent Hargis, PhD, Brian Holland, CFA and Ian McNaugher, CFA

Market volatility can shake the resolve of even the most patient investors. But creating a portfolio that consistently delivers a smoother pattern of returns is challenging and requires an active strategy that focuses on both down and up markets.

That matters now more than ever.

After two years of fighting inflation, the world’s central banks have pivoted by telegraphing monetary easing over the coming year. And while the global economy appears on track for a soft landing, investors are staring down several risks in 2024—including stubborn pockets of inflation, geopolitical instability and market concentration.

Any of these risks could ratchet up market volatility, bolstering the case for defensive equity strategies. But while most low-volatility strategies can provide some measure of risk mitigation in down markets, many fall short during market rallies—mainly because they’re designed solely for defense.

Is Minimum Volatility Really Low Risk?

Minimum-volatility (min-vol) strategies—often packaged as passive ETFs—are some of the most popular variants of defensive equity investing. These strategies systematically seek low-volatility stocks to aggregate into a portfolio. Typically, they include large allocations to traditional defensive sectors like utilities and consumer staples—bond proxies that can generate income and act as defensive stalwarts during market turbulence.

But the past two years illustrate their shortcomings.

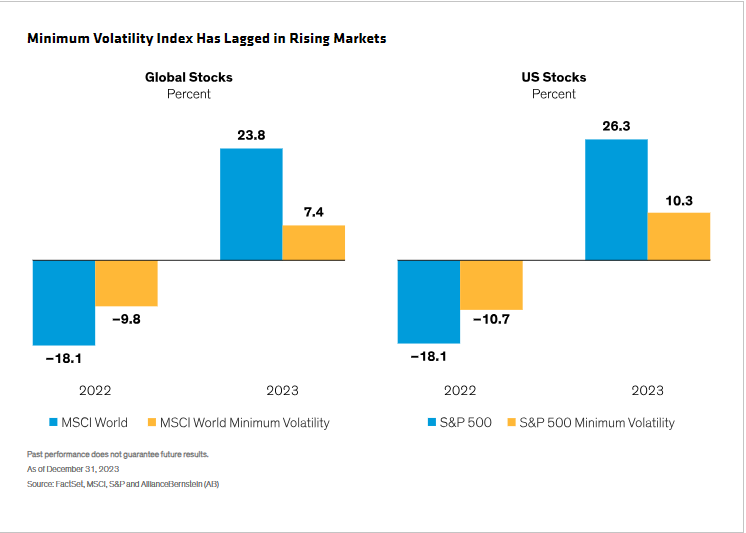

When global stocks tumbled in 2022, the MSCI World Minimum Volatility Index (Min-Vol), a popular benchmark for the category, successfully cushioned declines (Display). But in 2023, global equities rallied nearly 24%, fueled disproportionately by a small number of US megacap stocks. During this time, the Min-Vol Index rose by just 7.4%—badly underperforming the market. Similar patterns were observed in the US.

This sizable performance gap in rising markets underscores the primary weakness of common min-vol strategies. Sure, they help buffer against down markets. But in rising markets, they often fail to deliver on client needs for capital growth. Over time, lopsided return patterns inflict a huge long-term cost on investment results.

What’s needed is an active approach.

Reducing Downside Losses While Capturing Gains

Building a resilient portfolio that both mitigates risk and captures the upside is no easy task, but it’s doable. In our view, the key is to look for quality stocks with stable trading patterns that can be purchased at reasonable valuations (what we call quality, stability and price, or QSP).

Quality companies help drive upside participation because they have strong business models and recurring revenue streams that can withstand economic pressures through changing market environments. Stability can help curb losses in down markets, while a focus on attractive valuations can help investors steer clear of overvalued stocks—particularly important when traditional defensive sectors are in vogue and may see their prices driven up.

But these components don’t work in a vacuum—they’re interdependent. After all, quality stocks won’t exhibit stability if they’re too expensive. If stock markets correct after a strong year, expensive names may be among the hardest hit, in our view. For that reason, we believe it’s important to select stocks at attractive valuations when constructing a defensive equity portfolio—especially in today’s market, when higher interest rates can induce valuation risk and when some of the most popular, high-flying technology stocks look pricey.

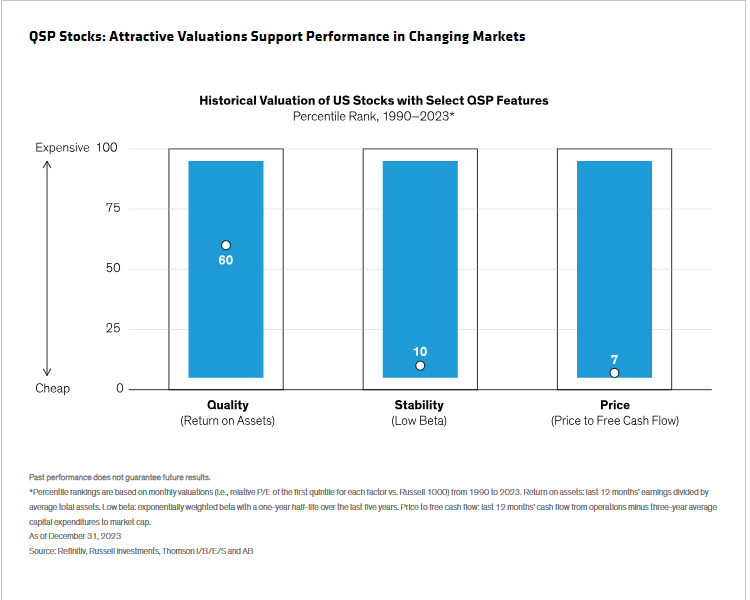

But can investors find defensive stocks at appealing valuations today? We think so. Our research shows that quality US stocks (companies with high return on assets) are fairly valued at the 60th percentile of their monthly history since 1990. Stocks with stability features and low prices trade near the low end of their 33-year valuation range (Display). So, by looking through a QSP lens, we think active investors can identify attractively valued stocks across a wider range of sectors than is typical for defensive portfolios.

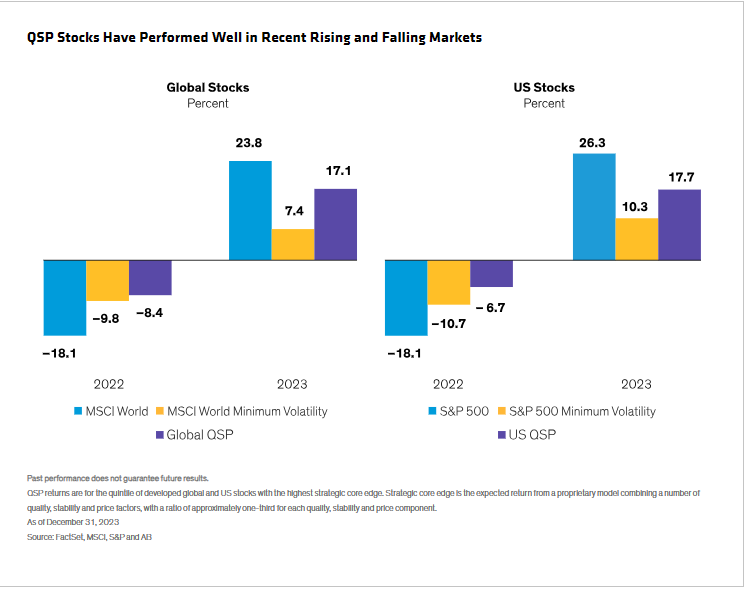

These types of stocks also have a solid track record in both falling and rising markets (Display). In 2022, our universe of global equities with strong QSP features fell by 8.4%—cushioning market declines similar to the Min-Vol. And last year, that same group of stocks advanced by 17.1%, capturing much more of the market’s gains than the Min-Vol.

No Contradiction Between Defense and Capital Growth

An active approach using thoughtful, fundamental research can uncover these often-overlooked names in a way that passive min-vol strategies can’t. That’s because passive strategies aren’t generally sensitive to valuations when allocating to low-volatility stocks. Moreover, passive portfolios can’t sift out and adjust the weights of individual stocks with high valuations. By contrast, active management can help identify businesses with hallmarks of quality and stability that aren’t fully appreciated by the market. Keeping valuation front and center provides a powerful antidote to potential market volatility—and a pathway to long-term gains.

There’s no contradiction between positioning for long-term capital growth and striking a defensive posture, in our view. Portfolios that achieve these twin targets can help investors stay in equities through changing market conditions.

At the start of the year, the world economy faces an especially wide range of potential outcomes. As a result, the trajectory of market returns is uncertain and could be volatile. An active approach focused on QSP stocks with a keen eye on valuation can provide investors with more levers to manage volatility in a year that could be full of surprises.