Written by: Horizon Investments | Horizon Investments

How well are you protecting your clients’ wealth?

All investors eventually reach the stage where the goal they’ve been saving for finally comes into view. It could be a couple who will need to start paying college tuition bills soon, or the worker who is five years out from retiring.

That’s when a financial need, goal or dream can really start to seem real. It’s also when you’re likely to hear clients say something like this:

“I know I need to invest, but I don’t want to lose what has taken me so long to save.”

The fact is, most investors nearing their goals want to take steps to protect their wealth so it’s there for them when they truly need it. Although managing wealth is not the same as playing a game, they do have one thing in common: You need a plan to play effective offense and defense to achieve your clients’ objectives so they come out on top.

The upshot: It makes sense to consider the financial threats that these “protect-phase” clients face and evaluate the effectiveness of your current risk mitigation strategies.

Armed with that information, you can determine if you are helping maximize your clients’ probability of reaching their goals—or if you need to enhance your risk mitigation and wealth protection capabilities.

The time to prepare for risk is now

Now is an ideal time to review both your clients’ risks and your own risk management efforts. To see why, consider a typical client whom you probably frequently advise: pre-retirees — most of whom are currently in their 50s:

- They haven’t suffered a full-fledged bear market since 2009.

- They may be wealthier than ever, thanks to the market’s returns since 2009 (a 384% return from 03/09/2009 through 02/28/2018 for the S&P 500 Total Return Index).

- But they’re also likely more risk averse than they were back in 2009, due to being nearly a decade older and closer to the time they’ll need to start tapping their wealth.

Clearly it makes sense to take a hard look at your approach to risk mitigation now, before a major market downturn has clients panicking.

The 3 risks that successful risk reduction strategies address

To determine how well positioned you are to help clients who are in the “protect” stage of their goals-based investment journey, you first must recognize the three key risks that these investors must overcome to successfully fund their upcoming goals.

RISK #1: Losing significant amounts of wealth. The biggest threat to protect-stage clients’ ability to adequately fund their upcoming goals is not market volatility. It’s drawdown– the absolute dollar losses in their portfolios.

One reason: time. There simply may not be enough of it for these clients to recover from big portfolio losses, should they occur between now and the date that they need the money. Just think back to 2008. For clients on the cusp of retirement, it was the absolute dollar losses they suffered—and the time needed to recover—that mattered most.

Consider what is required for investors to recoup portfolio losses.

- A portfolio that falls 10% needs to earn 11% to recover.

- A 25% loss requires a 33% gain to get back to break-even.

- A 50% loss requires a 100% gain to get back to the starting investment value.

Generating those types of gains over a timeframe of just a few years can be a tall order.

RISK #2: Missing out on upside growth. The risk of losing wealth is accompanied by the risk of missing investment gains during up markets by investing too conservatively or being out of the markets entirely. That means risk mitigation must strike the right balance between growth and protection.

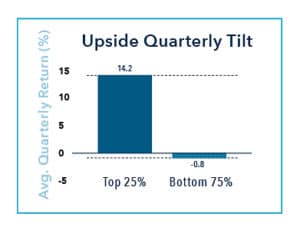

Missing up markets can seriously hamper wealth creation. Consider Exhibit 2. It shows that the top 25% of quarters for the S&P 500 in terms of performance returned 14.2%, on average, since 1928. In contrast, the remaining 75% of the quarters saw a negative average return of -0.8%.

Exhibit 2: Average Quarterly Performance of S&P 500—Top 25% of Quarters Versus Bottom 75% of Quarters (1928 – Q4 2017)

Source: Source: S&P 500 TR using data from SBBI Ibbotson, calculations by Horizon Investments.

Clients who miss some or all of the best quarters’ returns might see very little asset growth—a potentially major problem for investors who still require more wealth to achieve their goals. Such underfunded clients must continue to build wealth even as they take new steps to shield wealth they have created.

Lack of adequate growth could also spell trouble for you, as unhappy clients potentially begin to doubt the value you bring to them and look elsewhere for guidance.

RISK #3: Making bad, emotion-driven investment decisions. Risk management strategies do little good if they don’t prevent investors (and advisors) from making emotional investment decisions during extreme market conditions, when fear and greed can override clear-headed thinking.

Behavioral finance tells us that emotional reactions to market conditions consistently lead to bad behaviors—such as buying stocks at their peak prices, then selling them after they’ve fallen and turning a paper loss into a realized one. Likewise, investors often are slow to get back into the markets after they suffer a painful loss– causing them to remain overly conservative and potentially miss out on gains when markets recover.

It’s no wonder investors earn significantly lower returns over time than their actual investments generate (see Exhibit 3).

Exhibit 3: Performance of markets vs average mutual fund investors January 1, 1984 to December 31, 2015

Source: Quantitative Analysis of Investor Behavior (QAIB), 2016, DALBAR, Inc. www.dalbarinc.com. Average equity fund investor and average bond fund investor performance results are based on the DALBAR 2016 QAIB Study. DALBAR is an independent, Boston-based financial research firm. Using monthly fund data supplied by the Investment Company Institute, QAIB calculates investor returns as the change in assets after excluding sales, redemptions and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, expenses and any other costs. After calculating investor returns in dollar terms, two percentages are calculated for the period examined: Total investor return rate and annualized investor return rate. Total return rate is determined by calculating the investor return dollars as a percentage of the net of the sales, redemptions and exchanges for the period. Returns are for the period ending December 31, 2015

The message is clear: Any risk mitigation strategy must be systematic and disciplined–and applied consistently—to head off costly, irrational decisions. It also helps if the risk reduction strategy is clear and understandable to clients. If a plan makes sense to them, they’ll likely stick to it even on dark days.