Regardless of who the next U.S. President is, long-term interest rates look much higher

This U.S. election season has been nothing if not suspenseful. Who will win the White House? Will the Senate stay red? Will my own state of Florida be able to sort things out in a reasonable amount of time?

There are so many questions that will be answered in the days and weeks ahead. However, there is one that is getting clearer to me by the day. Long-term interest rates on U.S. Treasury securities appear to be on a collision course with the sky above. That is, they look to be heading higher soon. Maybe much higher.

Re-Introducing the 10-2 Treasury Spread

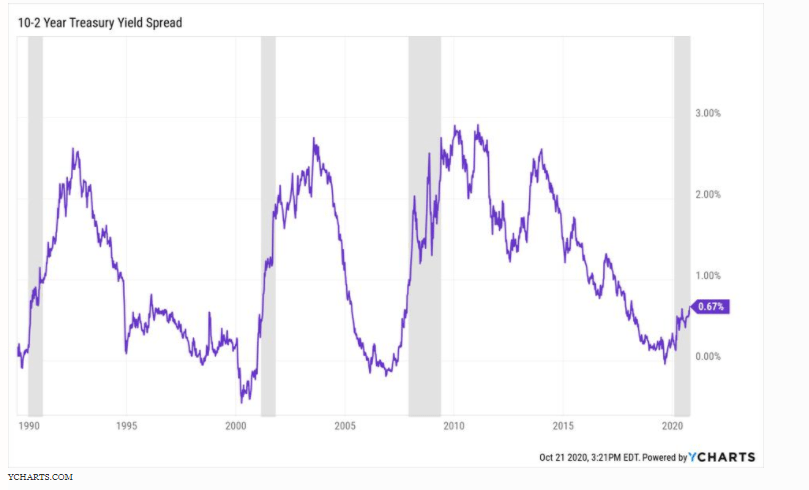

The chart below shows one of the most reliable recession indicators I know. The “10-2 Spread”, which I have written about before in this space, simply takes the yield on 10-year U.S. Treasury Notes, and subtracts the yield on 2-year U.S. Treasury Notes.

The 10-2 spread has been a very good indicator of past recessions. And, I remember being laughed at during 2019, when I pointed out that this indicator was showing many of the classic signs that lead to recessions.

The pattern is this: the 10-2 spread heads to zero, then rises up from zero. Within a matter of months, poof! U.S. recession. And, while a pandemic brought that recession on quickly, it was pretty clear that the risks of a recession were already very high, back when Corona was for drinking, not masking.

But the recession is already here, so…

Now that a recession is here, what comes next? My guess, based in part on the picture you see above, is that long-term interest rates are going to move noticeably higher during 2021. You see, when the 10-2 spread hits zero and then starts to rise, it typically doesn’t stop until it reaches the 2.5% – 3.0% range.

Taking the 10-2 spread at only 0.67% in the chart translates to a much more vigorous move higher into next year. This seems to me to be one of those “quiet” risks that many investors are not focused on today.

2-year Treasuries yield nearly zero, and that is closer to the overnight rates that the Fed directly influences. The Fed has made it clear that they are on hold for a while. But they don’t control long-term rates. The bond market does.

Who are you (who-who, who-who?)

And that is where this gets interesting or frightening. Which one depends on what type of investor you are. If you embrace a more flexible, tactical approach, this could be an opportunity. However, if you are the type of investor who just hopes things get better, but doesn’t actually do anything, under the guise of being a “long-term investor,” perhaps I can make you think twice here.

If we assume that the Fed will keep the 2-year Treasury rate at near zero as they have said, that means the 10-year Treasury could be headed toward the 2.5%-3.5% range in time. Maybe that doesn’t sound like much, but it could drop the bond part of your portfolio by 20-30% or so, if that type of move occurs. If you own more speculative bonds or bond funds, add some more to that estimate.

What to do about this

This is currently a threat, but it still needs to take place to actually impact your portfolio. The question is, if you agree with me that this is a real threat to your wealth, what do you do about it? Here’s a quick punch-list:

- Review your portfolio for this type of interest rate risk

- Consider whether you can get to your goals without relying so much on bonds. Eventually, higher rates will indeed be a threat.

- Know that vehicles exist that actually aim to profit from this type of rise in rates

- Watch the 10-2 spread, to see if it continues moving up the way it has lately. In other words, the way it has in every recession since 1990.

Electoral collage

The election is on all of our minds. However, the election itself is not what will impact your wealth going forward. It is the reaction of the markets to the election, and everything else that occurs around it, and elsewhere.

So, with a clear pattern in place for the 10-2 Treasury yield spread, at least we have solved a bit of the mystery surrounding the upcoming U.S. Presidential election. In the coming weeks, I expect to share more insight regarding post-election portfolio strategy.

Related: How To Teach Investing To Kids