When Consumer Staples stocks outperform tech, it usually means a rough market

If you follow the stock market, you know that the technology sector has been in a class by itself. In fact, I wrote an article earlier this year that argued that tech should be its own asset class. And that means we should treat the tech-heavy Nasdaq NDAQ +1.4% 100 Index as if it’s on an island by itself.

One big party

Sometimes, that island is one big party. Lately, the Nasdaq has been the best party on campus, bar none. It has left the rest of the stock market sectors in the dust. By doing so, it has carried the market, and obscured some serious weakness in other sectors.

The Nasdaq/tech dominance in 2020 has caused many investors (including me) to recall the heady days of the Dot-Com Bubble. However, there is one BIG aspect of that period that many forget. I am here to remind you.

The bursting of the Dot-Com Bubble twenty years ago led to 3 consecutive down years for the S&P 500. However, just as the Bubble was the biggest we had seen in a generation or two, the bust of the bubble was over-hyped as well. The “market” fell, but several sectors made it through OK. In particular, the years 2000 and 2001 were pretty friendly to certain market sectors. Investors found places to hide.

Fast-forward to today’s market, and I see potential for the same thing to occur. One clue is the recent behavior of the Nasdaq 100 Index versus the S&P 500’s Consumer Staples sector. As the old expression goes, this is where Mrs. Isbitts hides the peanut butter…as well as the toothpaste, the soft drinks and the toiletries.

Staples, but not the kind you use to attach papers

That is, the things we consumers use every day. These stocks are generally considered more stable than most sectors of the economy. After all, even in a pandemic, you still need soap!

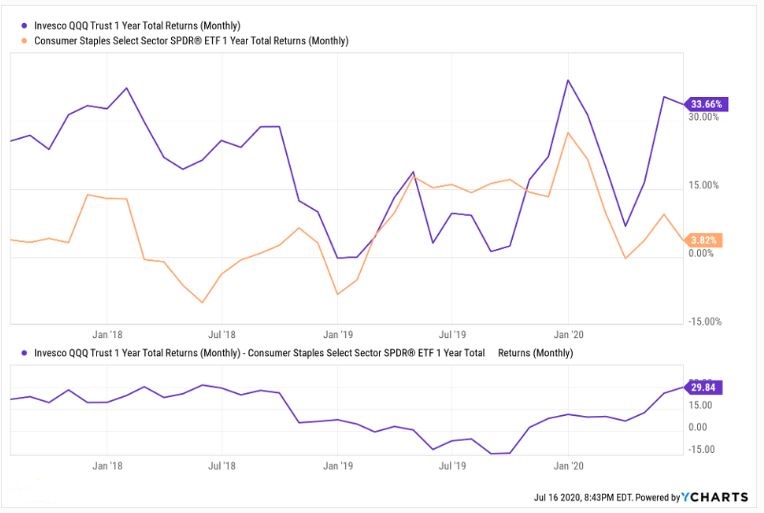

Here is a look at the back and forth relationship that has existed between the Nasdaq 100 and the Consumer Staples Sector over some very important time periods. Let’s start with the current period.

The chart immediately below shows that the Nasdaq has outperformed Staples by an astonishing 30% over the past 12 months. That’s not normal! And probably not sustainable for too much longer.

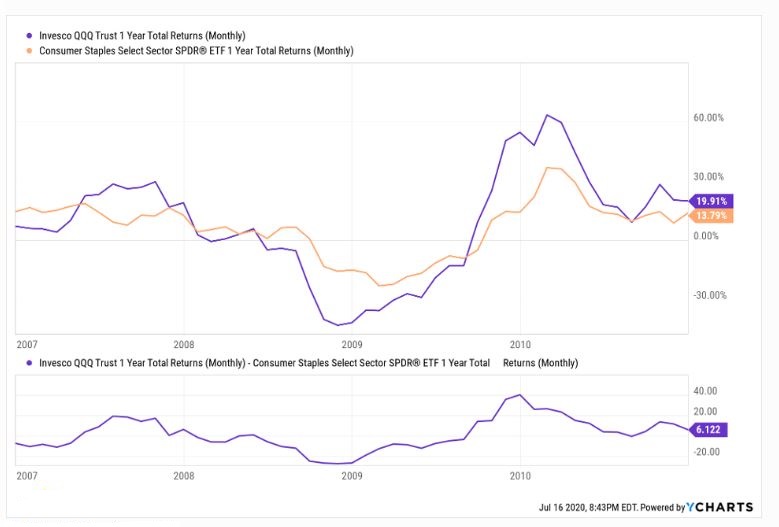

Next, here is the Dot-Com period. Nasdaq outperformed by as much as 50% in 12 months at one point. Then, the relationship flipped in a hurry. Consumer Staples stocks handily beat the Nasdaq, and for the first part of that period, were a profit-center in a generally tough market, especially for tech.

Finally, check out the Global Financial Crisis. Staples and Tech were close. and spent most of 2007 and early 2008 moving together. Then, as the crisis deepened in late 2008, the Staples practiced “social distancing” from the Nasdaq 100, and led the market out of the dungeon.

The opportunity in these sectors is in recognizing that they are often moving in very different ways. That creates an opportunity to diversify and profit, for those who stay focused on these types of “arbitrage pairs” situations.

The next time the market rolls over for more than a few days or moments, think about how you can profit not from what you buy in isolation, but what combinations of securities you buy together. There is no better time to approach investing in ways you never thought of before. The times demand it.

Related: The Nasdaq Is Partying Like It’s 1999. What To Do About It.