It starts by re-thinking the 40. And then the 60.

I have written extensively about the inevitable decline, demise and irrelevance of so-called 60/40 portfolios, which allocate 60% of assets to some form of stocks, and the other 40% to some form of bonds. It is a subject that is very popular in professional investing circles nowadays. Who knew so many financial pros were fascinated by dinosaurs!

Yet that is what 60/40 portfolios are. The reasons are pretty apparent, once you think about it.

Dinosaur tracks

First, there’s the math surrounding potential future bond returns. Yes, I know that we cannot predict the future. But bond returns are mostly about math. And from today’s low rates, one of 3 things is likely: low positive returns, flat returns, or negative returns.

And, if your 60/40 portfolio is managed professionally, via a fund or managed account or otherwise, there is an outstanding chance that the 40% in bonds will not even return enough to cover that management fee! So, the math doesn’t work.

My approach: use bonds (via ETFs) as a tactical measure only, not for “buy and hold.”

That brings us to the 60% part of 60/40. Equity math is not as closed-ended as bond math. Bonds have maturity dates, stocks do not. However, what stocks do have is a 10-year bull market in the rearview mirror. That has created a bubble that threatens to produce lower equity market index returns than in the past.

My approach: continue using equities (via stocks and/or ETFs), but consider 2 aspects of equity investing that many investors have not been shown (because Wall Street has a vested interest in keeping them invested as-is).

First, be ready, willing and able to hedge your equity portfolio. Not against any decline in value, but against major declines. At our place, we call this ABL: Avoid the Big Loss.

Second, use tactical techniques that are in sync with today’s market environment. That environment is dominated by big-money participants who are not very sensitive to what they own. These include index funds, hedge funds, high-frequency traders, and others.

Don’t be a hopeful dinosaur

The increasing specter of algorithms and other computerized investment approaches should be enough to prompt investors to embrace a more rotational style in their equity portfolios. Because buy-and-hold becomes buy-and-hope very quickly. And hope is not a strategy.

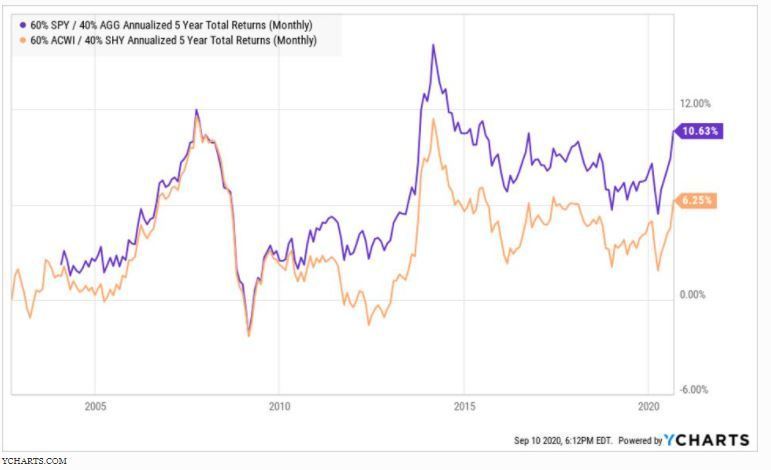

This chart shows (in purple) rolling 5-year returns of a common 60/40 portfolio (S&P 500 and Barclays Aggregate Bond). It also shows (in orange) the 5-year rolling returns of another 60/40 portfolio, one that allocates to a global stock mix, and that invests only in short-term bonds.

If the issues of bond math and stock bubbles are not enough to steer you toward a post-prehistoric era of investing, maybe this chart will. To me, the orange line is a more realistic, but still inflated view of what “classic” 60/40 portfolios might produce in the future.

Remember, this depicts the “glory days” for 60/40. The S&P 500 dominated everything in equity-land, and bonds were jacked up by falling interest rates. Bottom-line: investors may be too mesmerized by the past success of 60/40 portfolios to account for the realities of today’s markets.

Related: Here’s The Most Helpful Investment Stat You’ve Never Heard Of